OOIDA hopes to work with Missouri lawmaker on fuel tax

Related Articles

News

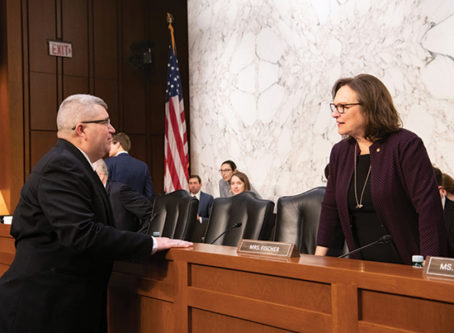

Truckers ‘are the solution’

Truckers know the best way to improve highway safety, OOIDA Executive Vice President Lewie Pugh told lawmakers during a Senate hearing.

By Mark Schremmer | March-April 2020

News

OOIDA’s view of the trucking industry

In addition to OOIDA’s oral testimony, the Association also submitted 26 pages’ worth of written testimony regarding the state of the trucking industry.

By Mark Schremmer | March-April 2020

News

A different way of seeing things

FMCSA approved an exemption request from Vision Systems North America to allow motor carriers to use the company’s Smart-Vision system instead of rearview mirrors.

By Mark Schremmer | March-April 2020

News

Fight continues over auto transporter definition

OOIDA continues its fight to get FHWA to remove regulatory guidance regarding the definition of automobile transporters.

By Mark Schremmer | March-April 2020

Keith Goble has been covering trucking-related laws since 2000. His daily web reports, radio news and “OOIDA’s State Watch” in Land Line Magazine are the industry’s premier sources for information regarding state legislative affairs.