Virginia board recommends against truck-only tolls in I-81 corridor

After spending the second half of the year doing research and conducting several public meetings, Virginia’s Commonwealth Transportation Board has published its final report of the I-81 Corridor Improvement Plan. In order to pay for more than $2 billion of projects, the board recommended either a regional tax or implementing tolls on all vehicles.

In April, the Virginia General Assembly passed Chapter 743 of the 2018 Virginia Acts, which directs the Commonwealth Transportation Board to study financing options for Interstate 81 corridor improvements. Within the directions, the board can consider “tolls imposed or collected on heavy commercial vehicles but shall not include tolls on commuters using Interstate 81,” leaving some speculation that a truck-only toll could be installed in Virginia.

On Dec. 21, the board published its final report that will be submitted to the General Assembly by Jan. 9. Two funding options are on the table: taxes or tolling.

Tolling option

The board identified four possible tolling options:

- Trucks only.

- Trucks and noncommuters.

- Variable tolling between daytime and nighttime for truck and noncommuters.

- Variable tolling with an annual pass.

“Of these four tolling options, options 2 through 4 best meet public input, federal and state tolling parameters, and generate sufficient revenue to meet the $2.2 billion needs,” the board determined.

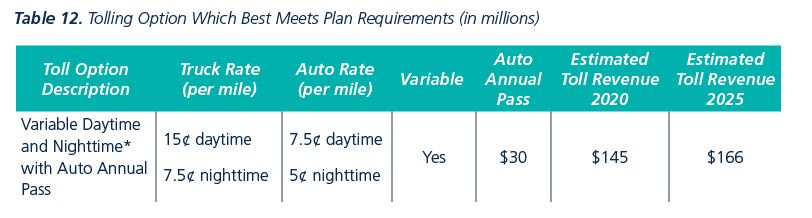

Although the General Assembly can consider a truck-only toll, the board recommended a more inclusive toll option. Assuming daytime hours of 6 a.m. to 9 p.m. and nighttime hours between 9 p.m. and 6 a.m., the board recommended the below tolling plan:

With the proposed toll rate, a truck traveling the 325-mile corridor will pay $48.75 during daytime hours and $24.38 during nighttime hours.

The option includes an annual auto pass for commuters. For an annual fee, passenger vehicles used for the purposes of commuting will have unlimited use of I-81 without paying tolls. This provision avoids tolling commuters, as instructed by the General Assembly.

Exact locations of toll gantries was not determined. However, the final report suggested gantries be spaced out at least 40 miles and be located near major reconstruction and bridge improvement projects. The plan assumes six gantries in each direction.

Regional tax option

Another potential source of funding for I-81 corridor projects could derive from additional taxes in the region. More specifically, the Commonwealth Transportation Board suggests two taxes: a retail sales/use tax and a fuel tax.

If state lawmakers choose this route, a retail sales tax at a 0.7 percent rate and a fuel tax at 2.1 percent would be implemented. The General Assembly has authorized a similar tax before in Northern Virginia and Hampton Roads.

Estimated annual revenue for the tax option would reach $165 million by 2020, $20 million more than what the toll option is expected to earn. By 2025, annual revenue under the tax option could hit $179 million, an increase of $13 million compared to the toll option.

What’s next?

The Commonwealth Transportation Board was only tasked to come up with a final report on financing options for the I-81 corridor improvement projects and have that submitted by the start of the next session on Jan. 9.

Once in the hands of the General Assembly, any number of possibilities can occur, ranging from completely ignoring the report to adopting options exactly as proposed in the report. Despite the fact the report does not suggest a truck-only toll, lawmakers could decide to go that route anyway.

If the General Assembly decides to fund projects through tolls rather than taxes, proposed gantry locations will need to go through the standard environmental impact process, which will require the approval of the Federal Highway Administration.

To read the full report, click here.