Canadian insurance association highlights need for stronger driver training standards

A report commissioned by the Insurance Bureau of Canada emphasizes the importance of strong entry-level truck driver training standards, while also suggesting companies should continue training new drivers.

The Canadian insurance association wanted to know which factors are impacting insurance costs for truck drivers. Unsurprisingly, age and experience play a major role. The report suggests that better truck driver training regulations can mitigate higher costs associated with experience.

According to the report, younger drivers and/or drivers with less than three years of experience tend to be involved in more crashes. Those crashes also tend to be more severe than crashes involving older, more-experienced drivers. Consequently, insurance premiums for younger or less-experienced drivers are higher.

Truck driver training standards

Costs associated with inexperienced drivers can be mitigated with better entry-level driver training, the report suggests.

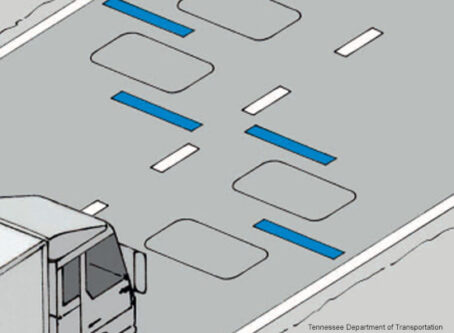

In 2021, the Canadian Council of Motor Transport Administrators established National Safety Code Standard 16, which sets entry-level truck driver training standards. At minimum, NSC Standard 16 calls for 103.5 hours of instruction, including 36.5 classroom hours, 17 in-yard hours and 50 in-cab hours. The standard also includes 8.5 hours of airbrake instruction.

However, NSC Standard 16 is only a national framework. Each province and territory is responsible for establishing its own entry-level truck driver training regulations. Not all jurisdictions have installed a mandatory entry-level training rule. Among those that have, specific requirements vary.

Although truck driver training programs exist in Canada, the report suggests that they inadequately prepare new drivers for the realities of the road.

“Entry-level training programs in Canada are not designed to fully prepare drivers for operating heavy trucks in all conditions,” the report states. “Entry-level programs are intended to provide exposure to the industry and basic skills to pass the Class 1 test. They do not cover the full range of competencies required of drivers, which means that graduating drivers do not yet have the full set of skills required to be road-ready.”

Truck driver training is only as good as the school providing the instruction. The report points out concerns over the quality of some schools and the lack of oversight ensuring trainees are being provided adequate instruction. For example, there are only eight inspectors in Ontario responsible for auditing the nearly 200 schools as well as the registered private career colleges.

In addition to the truck driving training standards, the report suggests trucking companies include onboarding and mentorship in their programs.

“Regular one-on-one mentoring and training from experienced drivers can increase the safety of new drivers,” the report states. “Coaching interventions (i.e., one-on-one discussions with an experienced driver) and Behavior-Based Safety (BBS) methods (which include regular coaching by an experienced driver) have been found to be effective in reducing driver errors (i.e. harsh braking and cornering) and safety-related events.”

Other crash rate and insurance factors

Other than experience and training, the report also found several additional factors related to crash rates.

Most notably, stakeholders indicated that Canadian truckers who travel to the United States are susceptible to higher insurance premiums. Why? Exposure to “significant jury verdicts.” Several states have addressed large verdicts against trucking companies, including a bill currently in the Wisconsin Assembly.

Factors affecting crash rates include:

- Higher traffic volumes

- Crash severity higher in rural areas

- Crash frequency higher in urban areas

- Distracted driving

- Time constraints of hours-of-service regulations increase risk

- Winter conditions, especially in western provinces

- Credit score strongly correlated with risk

“The property- and casualty-insurance industry is working closely with the trucking sector to find solutions to some of the challenges it currently faces, including driver shortages and access to adequate training and risk management,” Celyeste Power, Insurance Bureau of Canada CEO, said in a statement. “This third-party report echoes many of the recommendations that our industry has put forward, and we encourage governments across the country to use this report as a Call to Action to update and improve training and enforcement standards.” LL