Pricing power shifts to the shippers, DAT reports

The market has flipped, folks.

After several weeks with trucks in high demand, truckload freight volumes on DAT MembersEdge dropped abruptly during the week ending April 5. The number of available loads gave up 39% compared to the previous week.

At the same time, the number of load searches is skyrocketing as pricing power shifts to the shippers. Posted capacity increased 13% compared to the previous week, the largest week-to-week gain in available trucks so far this year.

National average rates, March

- Van: $1.87 per mile, 8 cents higher than the February average.

- Reefer: $2.19 per mile, up 10 cents compared to February.

- Flatbed: $2.19 per mile, up 4 cents compared to February.

Rates declined from their March averages during the first week of April. From April 1-5, the average van rate was $1.85; the reefer rate was $2.09; and the flatbed rate was $2.08.

Key market trends

Short-term retreat

Reefer rates have given back a good portion of their March gains. The market is much closer to 2019 levels here, and it seems more likely that we will see reefer rates slip below last year’s levels in the next seven to 10 days. This will likely be temporary until the typical seasonal uptick toward the beginning of May.

Load-to-truck ratios slide

The national average van load-to-truck ratio was 1.5 last week, down from 2.8 the previous week. As van ratios skid toward 2019 levels, the national average reefer load-to-truck ratio fell to 2.6 from 4.9 the previous week.

Produce picking up

Reefer rates were higher on lanes originating in the Midwest and California, plus a few lanes out of Florida.

- Chicago to Kansas City, Mo., rocketed up 23 cents to $2.60 per loaded mile.

- Green Bay, Wis., to Minneapolis added 13 cents to $2.51.

- Stockton, Calif., to Portland, Ore., increased 16 cents to $3.09 (other Stockton lanes rose, too).

- Lakeland, Fla., to Baltimore rose 9 cents to $2.12.

- Los Angeles to Phoenix was up 11 cents to $2.97.

Borderline decline

There’s still plenty of reefer freight to be found in the Mexican border markets of McAllen, Texas, and Tucson, Ariz., but average truckload rates trended down last week.

- McAllen to Atlanta lost 22 cents to $2.45, and lane rates also dropped from McAllen to Dallas, Chicago, and northern New Jersey.

- Tucson to Los Angeles fell 19 cents to $2.44, but that rate is higher than it was three weeks ago.

- Rates also dipped on lanes from Tucson to New York and from Tucson to Chicago.

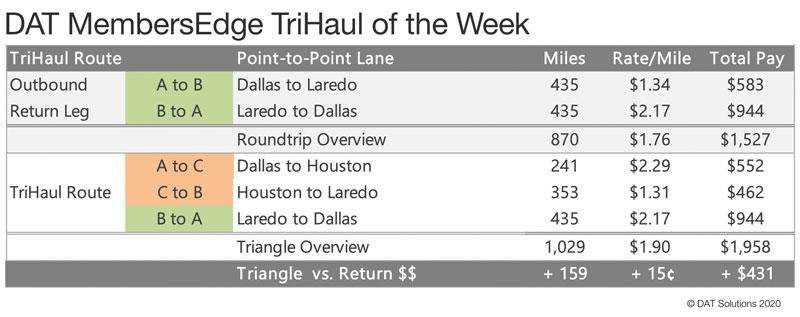

Tri-haul of the week

The average van rate from Dallas to Houston lost 16 cents to $2.26 and Houston to Dallas added a penny to $2.04. Not great, but not awful. If you can do the 500-mile round trip in a day, you can still make money there.

But Dallas-Houston could be a good choice as a third leg of a tri-haul to improve a roundtrip between Dallas and Laredo, Texas.

Dallas to Laredo paid only $1.34 per loaded mile, but van carriers averaged $2.17 per mile from Laredo to Dallas. So when you’re leaving Dallas, find a load to Houston instead at $2.29 per mile for 241 miles. Houston to Laredo paid $1.31 last week, but the distance is almost 100 miles shorter than Dallas to Laredo. And the reward is that 435-mile trip back from Laredo to Dallas. You might be able to finish that leg in one day, since traffic is pretty light lately.

The end result is a $2,000 tri-haul instead of a $1,500 roundtrip. The average rate per loaded mile is only 15 cents more but you’re adding 160 miles, and most of those pay above-average rates.

These rates are averages from last week, and this week could be different.

Truckload rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.

For the latest spot market load availability and rate information, visit the load board or tune in to Land Line Now. You can get all of the latest rate information at DAT.com per industry-trends per Trendlines, comment on the DAT Freight Talk blog, or join us on Facebook. On Twitter you can tweet your questions to us @LoadBoards and have your questions answered by DAT industry analyst Mark Montague.