Freight markets trending positive heading into June

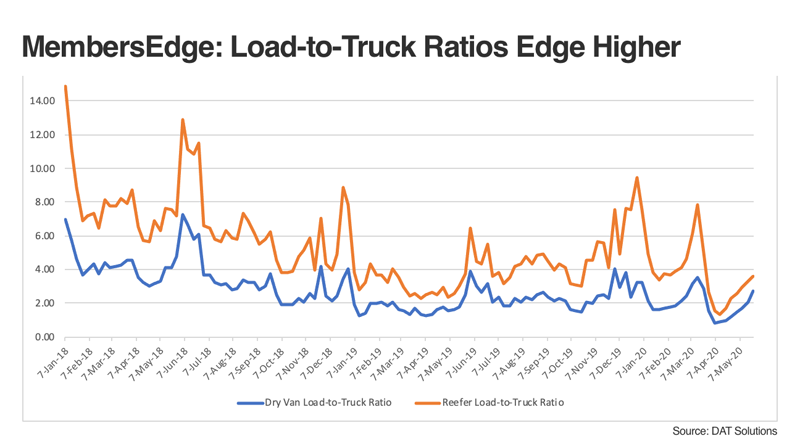

Spot truckload freight markets continued to gather momentum last week as load-to-truck ratios increased for dry van, reefer, and flatbed freight. Truckload rates followed suit, rising on most lanes just in time for June, typically a peak month for the spot market.

The number of posted loads on DAT MembersEdge jumped nearly 10% during the week ending May 31, which had one fewer workday because of Memorial Day.

And compared to April, load-posting activity on the spot freight market increased 79.6% in May while truck posts declined 15.7%.

National average spot rates through May 31

- Van: $1.60 per mile, 3 cents lower than the April average.

- Flatbed: $1.90 per mile, 4 cents lower than April.

- Reefer: $2.02 per mile, 9 cents higher than April.

Those are rolling averages for the month and current rates are higher. On June 1, the van spot rate averaged $1.72 a mile, the flatbed rate was $1.98, and the reefer rate was $2.08.

Freight market trends

Party like it’s 2019

At 2.8 loads per truck, the national average van load-to-truck ratio is on track with the same period in 2019, a soft year for spot freight but an improvement compared to the last five weeks. Spot rates last week were higher on 79 of DAT’s top 100 van lanes by volume compared to the previous week. The number of loads moved on those 100 lanes last week was lower by an average of 18%, in line with expectations for a holiday-shortened workweek.

Retail freight is on the move

In another sign that economies are reopening, outbound rates increased in several retail freight markets last week. Los Angeles averaged $2.32 per mile, up 12 cents compared to the previous week, and Stockton, Calif., averaged $2.09 per mile, up 15 cents. Rates from Atlanta ($1.80, up 9 cents), Charlotte, N.C. ($1.82, up 14 cents), and Columbus, Ohio ($1.85, up 14 cents) also made strong gains.

Finally, flatbeds improve

It’s already been a long year for flatbed carriers but conditions are improving. The national average flatbed spot rate is still less than $2 a mile on a 19.2 load-to-truck ratio but several lanes are reflecting increased demand for trucks. Among them:

- Birmingham, Ala., to Chicago jumped 21 cents to an average of $2.09 per mile.

- Roanoke, Va., to Baltimore rose 17 cents to 2.52 a mile.

Produce season swings higher

The national average reefer load-to-truck ratio was 3.7 last week, a half-point higher than the previous week. Rates increased on 42 of the top 72 reefer lanes by volume. Fourteen lanes had lower rates compared to the previous week and half of those were out of Florida. In a one-week period, Miami to Atlanta went from an average of $1.87 to $1.68.

Cross-border markets ripen

Peak shipping season for Mexican produce is driving demand for trucks in Nogales, Ariz.; McAllen, Texas; and Ontario, Calif. Check out two lanes from Nogales:

- Nogales to Dallas increased 29 cents last week to an average of $2.89 per mile. That lane averaged $1.88 a month ago.

- Nogales to Chicago shot up 23 cents to $2.41, an increase of 69 cents over the last four weeks.

This summary’s month-to-date national average rates were generated using DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $68 billion in freight payments. Actual spot rates are negotiated between the carrier and the broker.

For the latest spot market updates, visit DAT.com/industry-trends/covid-19 and follow @LoadBoards on Twitter. You can post comments on the DAT Freight Talk blog or on the DAT Facebook page. You can listen to the DAT MembersEdge report every Wednesday on Land Line Now.