DAT Solutions: Spot truckload volumes jump 29%, but rates hold steady

Load postings on MembersEdge jumped 29% and load-to-truck ratios rose for all three equipment types during the week ending Sept. 29.

The increase makes up for the 25% loss in volume during the previous week when Tropical Storm Imelda disrupted supply chains across the Southeast and Midwest. The number of truck posts increased 19%, reversing a 17% decline the previous week.

Spot van, reefer, and flatbed rates, on the other hand, were largely unmoved, except for a higher fuel surcharge.

National average spot rates, September 2019 (through Sept. 29)

- Van: $1.84 per mile, 3 cents higher than the August average.

- Flatbed: $2.19 per mile, 1 cent lower than August.

- Reefer: $2.16 per mile, 2 cents higher than August.

Van trends

Rates typically rise with freight volumes, especially during the final week of a business quarter, but were higher on just 32 of DAT’s top 100 van lanes. The national average van load-to-truck ratio averaged 2.2, up from 2.1 the previous week.

Where rates were up

Volume from Houston increased 20% and Charlotte was up 19%. But in keeping with the national trend, outbound rates in both markets ($1.68 and $1.98 per mile, respectively) failed to budge. West Coast lanes were better. Seattle rose 6 cents to $1.63 per mile, mostly on southbound lanes. Seattle to Los Angeles gained 8 cents to an average of $1.31 per mile. Freight availability in Los Angeles remains strong, with the load-to-truck ratio hitting 5.8 last Friday and averaging 4.2 last week.

Reefer trends

The national average reefer load-to-truck ratio increased from 3.9 to 4.2 as volumes picked up 2.4% on DAT’s 72 largest reefer lanes. Like the van market, reefer rates did not respond to more freight in the pipeline: only 18 lanes rose while 51 moved lower.

Where rates were up

Volumes from McAllen, Texas, increased 23% compared to the previous week and the average outbound rate rose 11 cents to $2 per mile. Importers had a backlog of produce to move to several major U.S. markets: the average rate from McAllen to Chicago gained 14 cents to $1.86 per mile, and McAllen to Atlanta was up 12 cents to $2.03 per mile. Apple harvests continue to drive reefer demand in upper Michigan, and Lakeland, Florida, had an unexpected rise in both volume and rates.

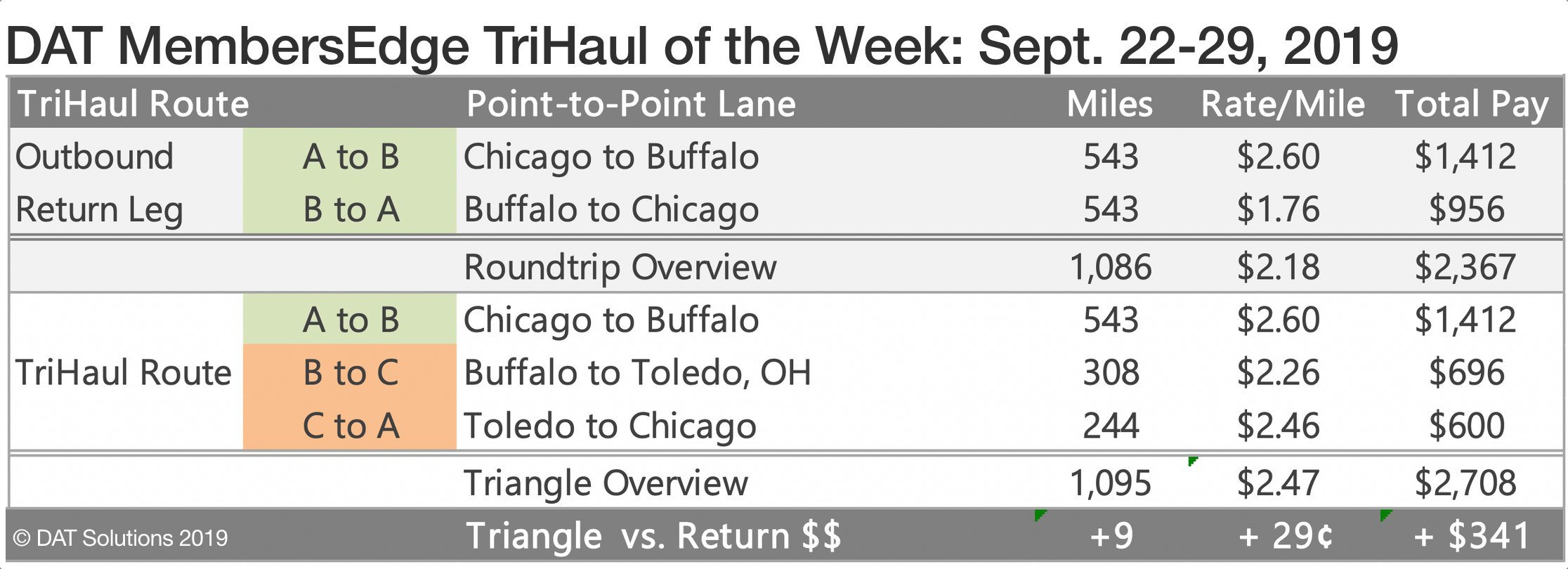

Tri-haul of the week

Chicago-Buffalo-Toledo-Chicago

The lane from Chicago to Buffalo increased 7 cents last week to an average of $2.60 per mile but the return trip paid just $1.76 per mile. If you have the professional version of DAT MembersEdge, you can request a tri-haul option and potentially boost your revenue and profit.

Instead of going straight back to Chicago, the lane from Buffalo to Toledo paid $2.26 per mile and Toledo to Chicago averaged $2.46 per mile. Based on last week’s rates, the straight round trip (which totals over 1,000 miles) averaged $2.18 per mile but the tri-haul would boost that to $2.47 a mile – delivering $341 more revenue without adding many miles to your trip.

Remember, these rates are averages from last week and this week could be different. Talk to the load providers and negotiate the best deal you can get on every haul, and look at the rates and load-to-truck ratios in MembersEdge to understand which way the rates are trending.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.

For the latest spot market load availability and rate information, visit the MyMembersEdge.com load board or tune in to Land Line Now. You can get all of the latest rate information at dat.com per industry-trends per Trendlines, comment on the DAT Freight Talk blog, or join us on Facebook. On Twitter you can tweet your questions to us @LoadBoards and have your questions answered by DAT industry analyst Mark Montague.