OOIDA Foundation market report reiterates new cycle not here yet

A new freight cycle is unlikely before the end of the calendar year, the OOIDA Foundation said in its April market update.

The reasons?

Volume and demand are weakening, capacity is loose and operating costs remain high.

“Some pockets of tightness are appearing in reefer and flatbed markets, but the truckload market is still well supplied, with private fleets increasingly competing for spot loads recently,” the Cass Shipment Index said.

Railroads and private fleets are handling any economic freight growth, according to Cass.

The Logistics Managers’ Index pointed to signs the transportation market was improving. But based on capacity, it’s clear a freight recession remains.

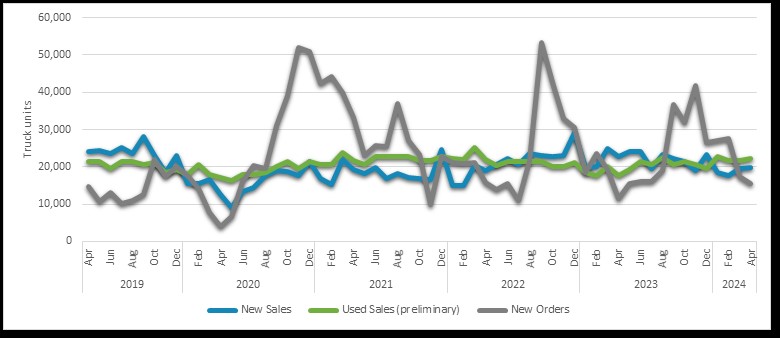

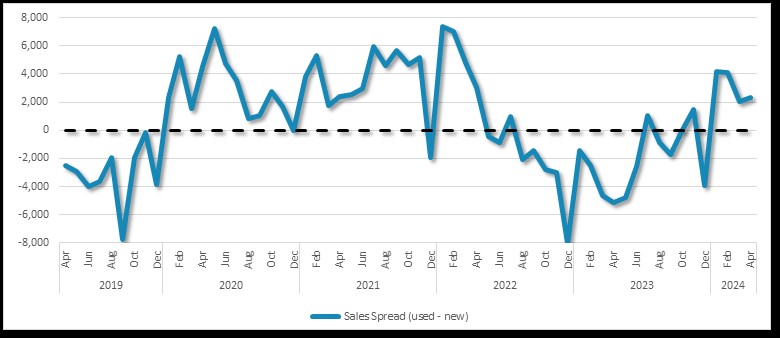

Class 8 orders and sales

Van market

Load-to-truck ratios increased in every region with the exception of three. The Florida-Southern Georgia region saw the greatest increase.

Both spot and contract rates declined in April.

The inventory-to-sales ratio increased despite a decrease in monthly sales.

Inventory levels of furniture and appliances are low, but demand has yet to increase.

Flatbed market

Load posts increased for the fifth consecutive month and were most favorable in the Southeast, Carolina and South Central regions.

The spread between contact and spot rates declined and is now 7% worse than this time last year.

Total construction spending decreased, while housing starts rebounded in April.

Building materials, garden equipment and supplies dealer retailers continued to struggle with high inventory levels.

“This is a significant headwind for future freight demand, as demand overall remains low,” the Foundation said.

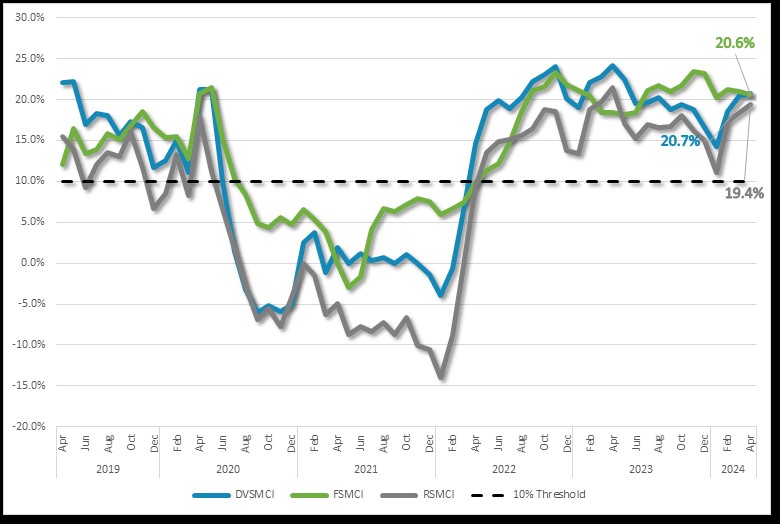

Spot market cycle indicator

Reefer market

Seven of the 15 regions reported a decrease in load-to-truck ratios, compared to just one region last month.

Spot rates decreased, contract rates decreased and the spread between the two grew.

According to USDA, carriers in the Florida region experienced the greatest increase in pay per mile month-over-month.

Volumes fell but were following the typical seasonal pattern.

Reefer truck capacity tightened slightly after several months of loosening as rates ticked upward overall. However, capacity still remained mostly flat across the country.

Trucking market

Employment numbers decreased, with non-seasonally adjusted numbers seeing an increase.

Unless something changes soon, a new cycle isn’t likely until 2025, according to the Producer Price Index.

Fuel prices through April have declined $1.75 per gallon since June 2022, when the national average diesel price per gallon was $5.75.

That average price has been down year-over-year for 14 straight months.

Preliminary used truck prices continued to decline in April and have now fallen 43%, or $43,424, since their high in March 2022.

Wages, salaries and real disposable income continued to grow year-over-year, but at a slower pace.

Retail trade stayed mostly flat in April, while durable goods and services increased in March. Non-durable goods declined.

The full OOIDA Foundation freight market update is available online. LL