Freight market remains dicey, OOIDA Foundation update says

Sometimes change is a good thing. In terms of the current freight market, it would be a very good thing.

But in its December update, the OOIDA Foundation again said the market outlook is negative – as it has reported since March 2023.

The Foundation said in its report that overall volume and demand are soft, capacity is loose, rates are flat and operating costs are high.

Specific market takeaways are below.

Van market

Load-to-truck ratios were more favorable for carriers in the Lower Mountain, Lower Midwest and Upper Mountain regions.

Across all regions, those rates fell by 9% and are now 47% below the five-year trend.

Spot rates increased, while contract rates went the opposite way. Inventory-to-sales ratios were down, with monthly sales remaining flat.

Without an uptick in demand, the freight cycle will remain in its current trough, the Foundation update said.

Flatbed market

Load posts are significantly lower than in 2019, and the load-to-truck ratio has declined year-over-year for 21 consecutive months.

DAT’s extended forecast predicts that flatbed spot rates excluding fuel will stay flat in January and then steadily increase to $2.11 until July 2024.

Construction spending in general remains incredibly elevated over 2019 levels, but flatbed demand is still falling.

An increase in demand is needed before any meaningful change in freight rates occurs.

Reefer market

Half of the regions saw a decrease in the load-to-truck ratio, with the biggest decrease in the Pacific Northwest (71.6%).

Both spot and contract rates decreased, while rates for trucks hauling fruit and vegetable goods dropped below their January 2022 high.

Florida saw the greatest increase in pay-per-mile.

Arizona and Texas had the largest increase in volumes.

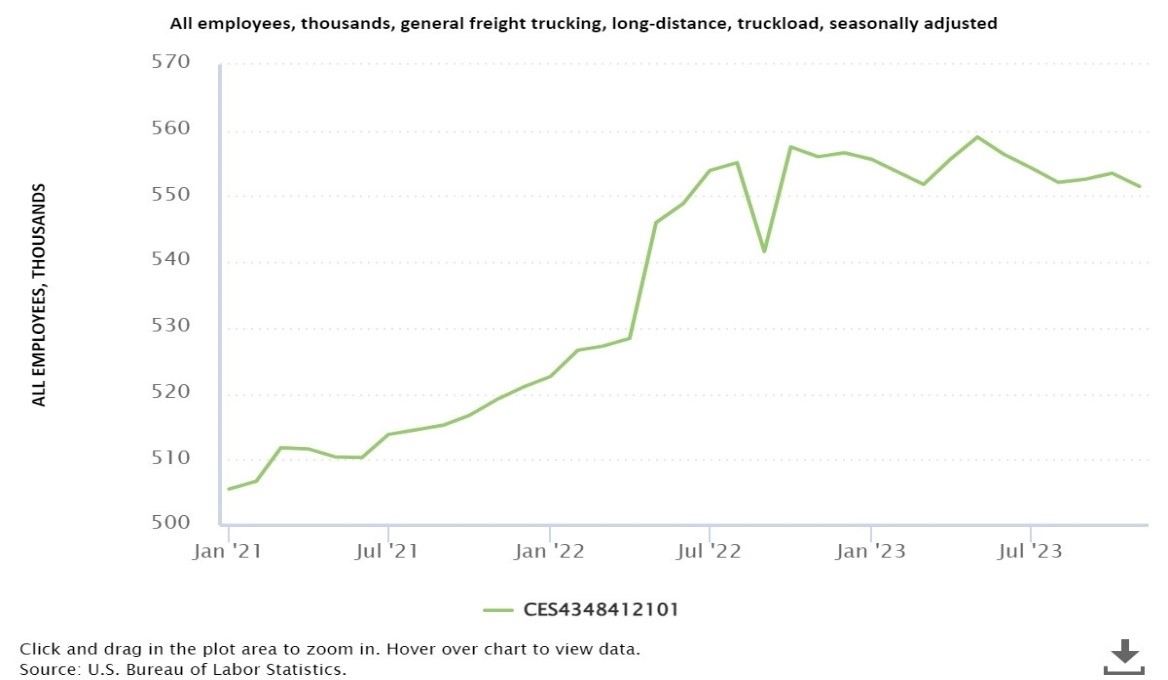

Trucking market

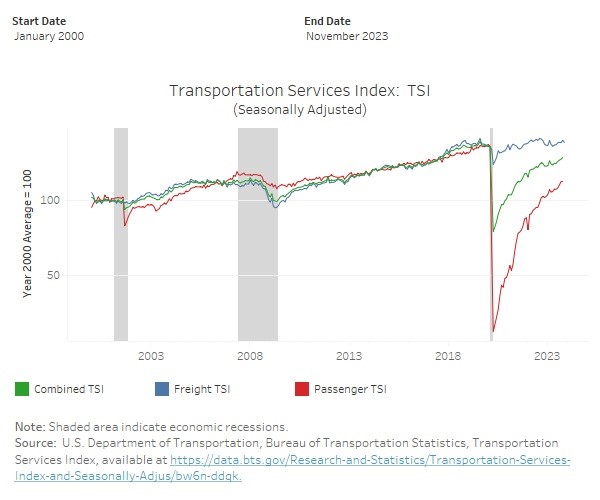

The Transportation Service Index showed a decrease in volumes.

However, the Cass Shipment Index said signs of improvement are visible.

“The acceleration in real disposable incomes, supported by a surprisingly sharp disinflation, and the ongoing strong labor market suggest freight demand fundamentals will improve in 2024,” Cass said.

It appears that the overall trend for the Producer Price Index has hit bottom and is starting to rise/level-off again.

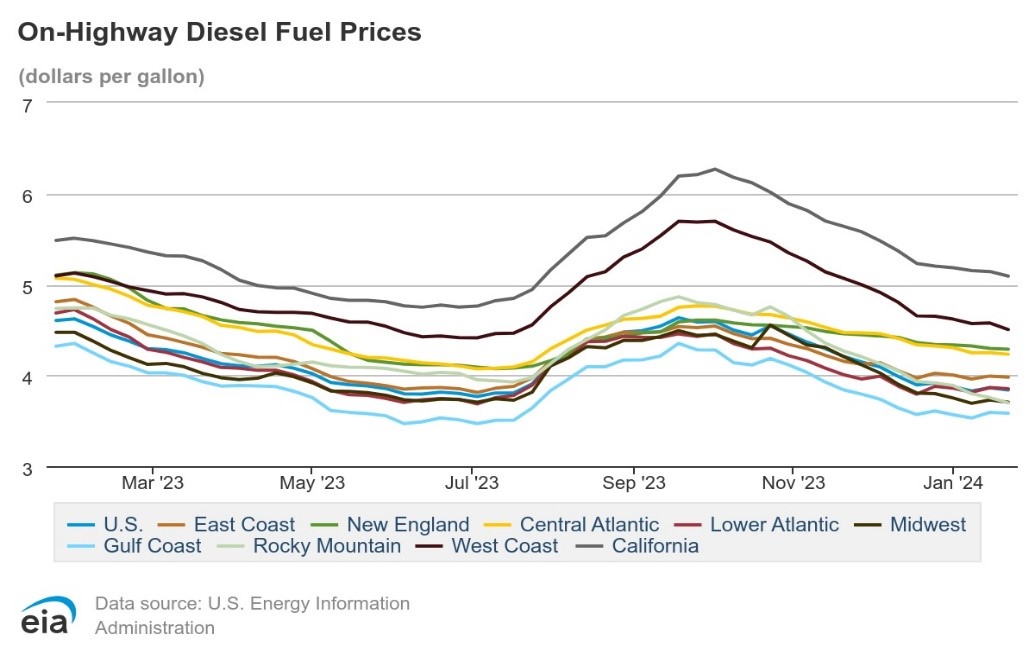

Fuel prices dropped again and have been down year-over-year for 10 consecutive months. Through December, fuel prices have declined $1.78 per gallon from a high of $5.75 per gallon in June 2022.

Preliminary used truck prices broke the downward trend in December, increasing slightly. Year-over-year comparisons have been negative for 13 consecutive months, a bad indicator for the overall freight market.

The complete OOIDA Foundation freight market update is available here. LL