Cost of operating a truck reaches all-time high

The cost of operating a truck has reached an all-time high, according to the American Transportation Research Institute.

Each year, ATRI releases an analysis of the operational costs of trucking. This year, estimated costs of operations in 2022 was $2.251 per mile. That marks the highest operational costs for a truck on record and the first time it has surpassed $2 per mile.

A significant factor in the increase is fuel prices, which increased by 53.7% to 64.1 cents per mile. Fuel costs account for the largest vehicle-based costs.

Accounting for the highest driver-based costs, driver wages are up 15.5% to 72.4 cents per mile.

Other significant increases:

- Truck/trailer lease or purchase payments up 19% to 33.1 cents per mile.

- Repair and maintenance up 12% to 19.6 cents per mile.

- Tires up 10% to 4.5 cents per mile.

Only two categories saw a decrease compared to the previous year. The cost of tolls is down 12.5% to 2.8 cents per mile. Permits and licenses are also down by more than 6% to 1.5 cents per mile. Combined, the two categories represent only 2% of the total cost of operations.

Adjusted by costs per hour, the total cost of operations for a truck is $90.78 per hour. Driver wages account for $29.20 per hour while fuel expenses account for $25.84 per hour.

Truck and trailer payments, repair and maintenance, auto liability insurance premiums, tires, and driver wages all set record-high marginal costs in 2022, according to the report. Driver wages grew at the fastest pace that ATRI has observed to date. The spike in truck and trailer payment costs constituted the greatest annual change since 2014 for that cost center.

Broken down by sector, the average cost of operations for truckload is $2.15. Comparatively, costs for less-than-truckload is $2.34, whereas specialized freight costs $2.44 per mile.

Fleet size matters. Small carriers (100 or fewer power units) have an average cost of $2.30 per mile. Meanwhile, the cost for large carriers is lower at $2.223. The most significant difference between the two is the cost of fuel. Small fleets pay on average 72.3 cents per mile while large fleets pay only 61.2 cents per mile. Large carriers’ ability to hedge fuel markets and secure bulk pricing enables them to achieve lower marginal fuel costs, according to the report.

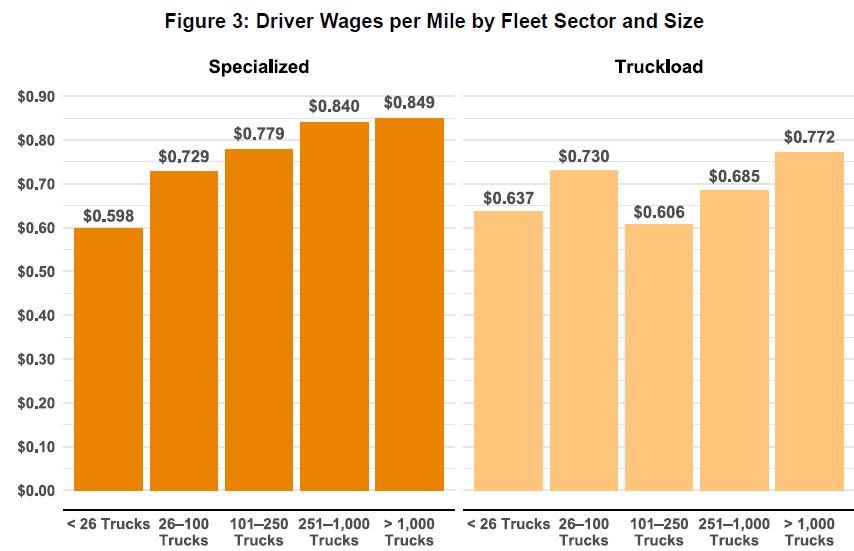

Driver wages for specialized freight increased as the fleet increased. However, average wages per mile for truckload operations fluctuated.

Costs by region also varied. The West had the lowest cost per mile at $2.157 despite significantly higher fuel expenses. However, the West also had significantly lower driver wages and benefits. The highest expenses are in the Southeast at $2.303, partly due to higher driver wages and benefits. Other regions include the Midwest ($2.195 per mile), Northeast ($2.207 per mile) and Southwest ($2.238 per mile).

Almost one in three (31%) truckload carriers compensated drivers for parking: 18% by reimbursement and 12% by advance reservation. This percentage is down from 54% in 2021. However, it remains higher than the 15% of drivers that received parking compensation in a 2016 ATRI study.

To see ATRI’s full report, click here. LL