Americans show more support for fuel tax increase than mileage fee

Although Americans are warming up to the idea of a mileage fee, they appear to be more open to an increase in the federal fuel tax as long as the revenue is being used appropriately.

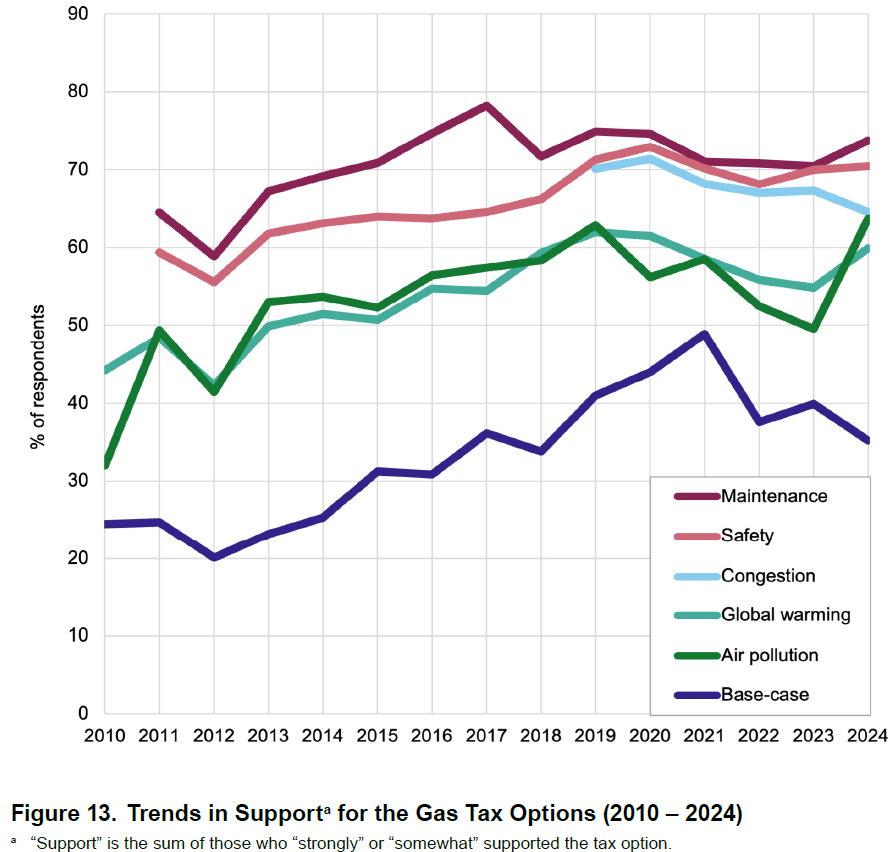

In its 15th annual survey looking into federal-level transportation tax revenue, San José State University’s Mineta Transportation Institute asked Americans about their thoughts on various fuel tax increases and novel mileage fees. A simple majority is fine with certain mileage fees, but nearly three-quarters support a fuel tax increase under certain conditions.

Survey respondents were asked whether they support a 10-cent increase to the existing 18-cent federal gas tax. They were given six different scenarios regarding how that revenue will be spent:

- Transportation in general

- Reduce local air pollution caused by transportation

- Reduce transport system’s contribution to global warming

- Maintain streets, roads and highways

- Reduce accidents and improve safety

- Reduce traffic congestion

Only 35% support a fuel tax increase if the money is spent on a vague description of transportation. However, support skyrockets to more than 70% if revenue goes toward road maintenance or to reduce crashes and improve safety. Only about 60% support a fuel tax increase if the money is used for environmental-related purposes or to address congestion.

When it comes to a mileage fee, people are less open to the idea.

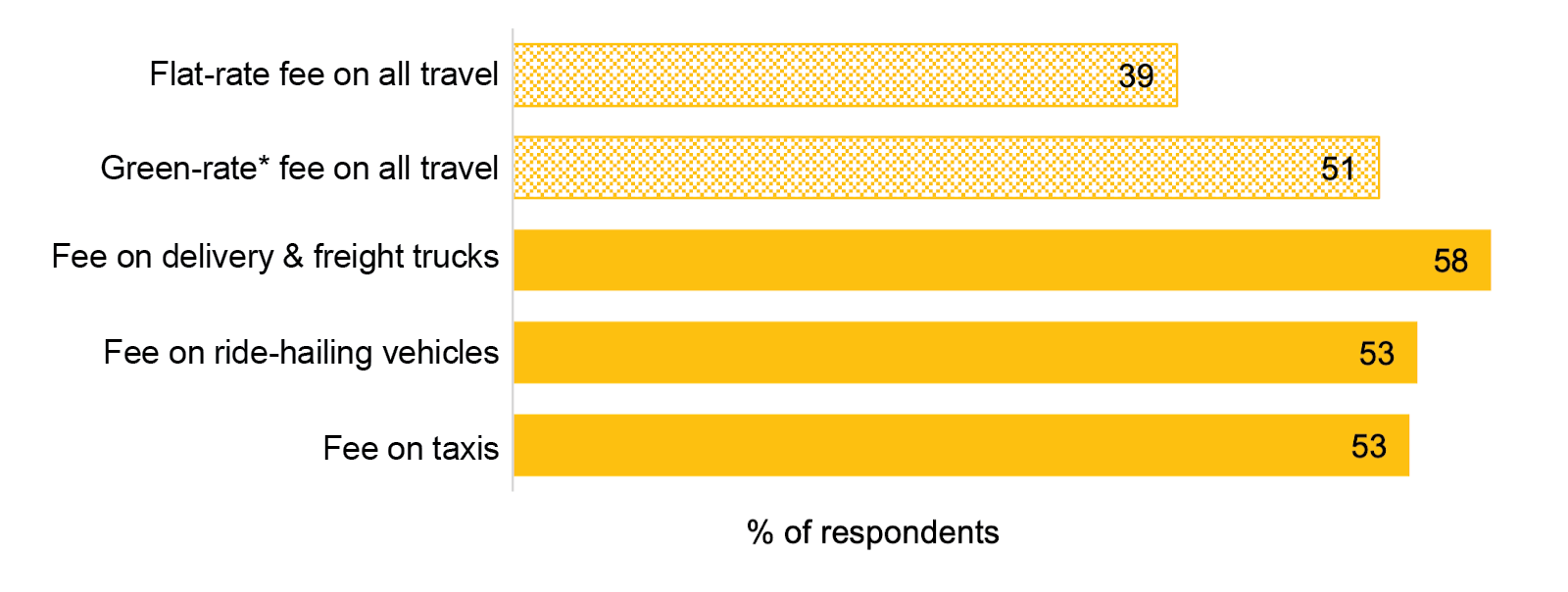

Respondents were asked how they feel about replacing the federal fuel tax with a fee that charges drivers for how many miles they drive instead. Only 39% support a flat-rate mileage fee of 3 cents per mile for all vehicles. However, half of respondents favor a variable green-rate fee where the average rate is 3 cents per mile, with vehicles polluting less charged less and vehicles polluting more charged more.

Compared to 15 years ago, support has gone way up for both a flat-rate fee and green-rate fee. Only 22% supported a flat-rate fee in 2010, with only 34% supporting a green rate.

The survey also reveals more support for a mileage fee on top of the federal fuel tax for commercial travel. Nearly 60% are fine with charging truckers an additional mileage fee, with 53% okay with the idea of an additional travel fee for taxis and ride-hailing vehicles like Uber and Lyft.

There does not seem to be a lot of support for giving electric vehicles preferential treatment. Nearly half of respondents believe electric vehicles should be charged the same rate as fossil fuel-powered vehicles for a mileage fee.

If a mileage fee were to be put in place, people prefer to pay incrementally. Nearly half favor paying each time they fuel up or charge, about a third prefer a monthly bill and about 20% like the idea of an annual bill.

It is worth noting that the survey may be skewed to favor those who do not drive much. Nearly two-thirds of survey respondents drove less than 7,500 miles in the last 12 months or not at all.

According the Federal Highway Administration, the average annual miles driven per driver is more than 13,000 miles.

The survey also revealed the lack of knowledge most Americans have when it comes to the federal fuel tax or mileage fees. Only 2% of respondents knew that the federal gas tax has not been raised in more than 20 years. About 60% have never heard about a mileage fee. Regardless of their lack of knowledge, more than half indicated they have privacy concerns about a mileage fee and half consider a mileage fee to be fairer than fuel taxes.

Although the Mineta Transportation Institute’s survey shows increasing support for a mileage tax over the last 15 years, a simple majority may pose a challenge for states looking into new ways to fund transportation. With vehicles becoming more fuel efficient, revenue from fuel taxes is dropping.

According to the Tax Foundation, only three states raise enough dedicated revenue to fund transportation spending. Most states have at least actively looked into a mileage fee. Four states currently have an active program for passenger vehicles, and four states have a program targeting heavy commercial vehicles.

Michigan is the latest state to explore the idea of a mileage fee. Next June, the state will begin a pilot program for a mileage-based road-usage tax. The state faces an estimated $3.9 billion annual deficit in road funding. LL

Land Line State Legislative Editor Keith Goble contributed to this report.