More truckers, fewer loads push spot rates lower

Truckload capacity is building in the first weeks of 2019, and national average spot rates for dry van, reefers, and flatbeds are not.

A sign of a seasonal slump, the number of trucks on MembersEdge increased 7 percent last week while the number of loads dipped 10 percent. National average spot rates responded in the negative.

- Van: $2.01 per mile, down 4 cents.

- Flatbed: $2.38 per mile, down 4 cents.

- Reefer: $2.37 per mile, down 5 cents.

Van trends

The number of van posts increased 8 percent but load posts declined 13 percent, which helped send the van load-to-truck ratio down 19 percent from 4.6 to 3.7 loads per truck.

That’s the lowest van load-to-truck ratio in eight months.

Setting in the West

The worst drops in spot van rates over the past month have been from the West Coast – Los Angeles and Seattle are down double digits since December.

This is not totally unexpected, given how the threat of higher tariffs pushed overseas shippers to get their freight to the U.S. as quickly as possible. Volumes surged during the last quarter of 2018. Now? Not so much.

Hot markets

Well, “hot” is relative. Denver outbound has been mostly neutral for the last month, and Philadelphia rates have stopped slipping. Much of that is due to a sharp price increase to Buffalo, which jumped 23 cents to $2.65 per mile last week, likely due to winter weather concerns.

Flatbed trends

Flatbed load posts fell 2 percent while truck posts increased 13 percent. The national flatbed load-to-truck ratio fell from 25.1 to 21.7 loads per truck. Still hanging on for construction season, which is weeks away.

Reefer trends

Last week reefer posts increased 5 percent while load posts fell 15 percent. The load-to-truck ratio dropped from 6.1 to 4.9 loads per truck. It has been more than six months since the reefer ratio has been below 5.

Chilly Rates

Average spot rates were down on several key regional reefer lanes and in major markets across the country.

- Los Angeles: $2.92 per mile, down 11 cents after an 18-cent decline the previous week.

- Atlanta: $2.56 per mile, down 5 cents.

- Lakeland, Fla.: $1.46 per mile, down 9 cents.

- McAllen, Texas: $2.24 per mile, down 7 cents.

- Philadelphia: $2.90 per mile, down 5 cents.

- Chicago: $2.80 per mile, down 14 cents after falling 13 cents the previous week.

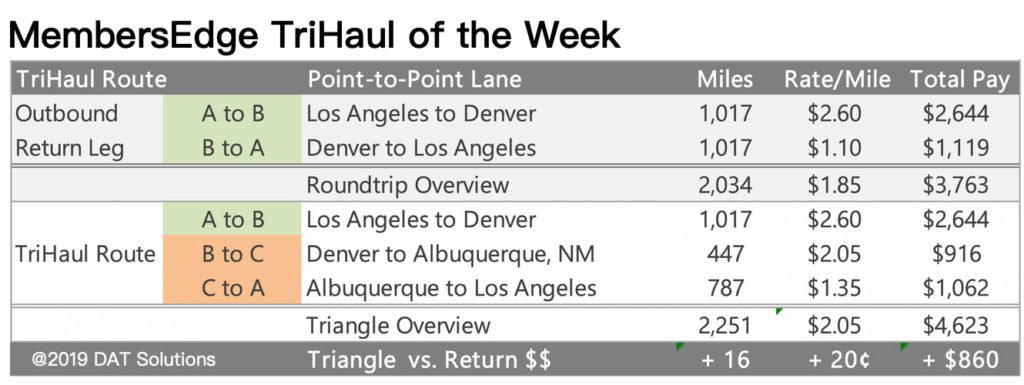

Tri-haul of the week

L.A.-Denver-Albuquerque-L.A.

Denver is one of the few van markets where freight pricing is holding up. But it’s notorious for low rates, so let’s find a tri-haul out of Denver and make more money.

Say you have a van load from Los Angeles to Denver, which paid an average of $2.60 per mile last week. Not bad. However, Denver to L.A. paid $1.10 per mile. There’s that Denver rate we’ve come to expect.

DAT MembersEdge can give you five tri-haul options based on your desired round trip, and one of the best for a Denver-L.A. trip included Albuquerque-Denver-Albuquerque averaged $2.05 per mile while Albuquerque-L.A. paid $1.35 per mile. This tri-haul would add just 16 miles to your route but increase your revenue by $860. If it works with your schedule, a tri-haul might be worth a look.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.

For the latest spot market load availability and rate information, visit the MyMembersEdge.com load board or tune in to Land Line Now. You can get all of the latest rate information at dat.com per industry-trends per trendlines, comment on the DAT Freight Talk blog, or join us on Facebook. On Twitter you can tweet your questions to us @LoadBoards and have your questions answered by DAT industry analyst Mark Montague.