DAT Solutions: Spot rates dip in first full work week of 2019

Last week was the first full work week of 2019, and truckers were back on the highways in full force.

The number of available trucks on MembersEdge increased 77 percent last week, well ahead of the 9 percent gain in available loads. The loose capacity knocked down national average spot rates for dry van, refrigerated, and flatbed freight.

- Van: $2.05 per mile, down 6 cents.

- Flatbed: $2.42 per mile, down 4 cents.

- Reefer: $2.42 per mile, down 5 cents.

Diesel prices continue to put downward pressure on rates. The average price of diesel dropped 4 cents last week to $2.97 per gallon nationally.

Van trends

The number of available vans surged 83 percent while load posts declined 5 percent compared to the previous week. That is a sign that shippers don’t have the same volumes (or sense of urgency) after the holidays. The van load-to-truck ratio dropped 48 percent from 8.9 to 4.6 loads per truck.

Rates slip

Rates during first full work week of 2019 were down on 84 of the top 100 van lanes by volume. Still, the line-haul portion of the national average spot van rate is equal to the December figure – only the fuel portion is down, so pricing power remains intact for now.

Stormy ports

Houston remains solid, with price declines that were less than in other ocean cargo markets. Average outbound van rates from Philadelphia (minus 6.4 percent), Stockton (minus 5.6 percent), Los Angeles (minus 6.6 percent), and Seattle (minus 6.5 percent) were all trending lower.

Lane with gains

Oklahoma City volumes gained strength last week, which may indicate supplies moving to support oil and gas projects in the region.

Flatbed trends

Flatbed load posts first full work week of 2019 increased 44 percent last week while truck posts surged 94 percent. The national flatbed load-to-truck ratio fell 26 percent from 33.7 to 25.1 loads per truck.

Reefer trends

Reefer capacity bounced back as truck posts jumped 57 percent. The number of load posts cooled considerably: down 3 percent. The reefer load-to-truck ratio fell 38 percent from 9.8 to 6.1 loads per truck.

Cooling off

Average spot rates were down on 62 of the top 72 reefer lanes, and average outbound rates fell sharply in many major markets.

- Los Angeles: $3.03 per mile, down 18 cents.

- Atlanta: $2.60 per mile, down 14 cents.

- McAllen, Texas: $2.33 per mile, down 15 cents.

- Dallas: $2.20 per mile, down 19 cents.

- Philadelphia: $2.96 per mile, down 11 cents.

- Chicago: $2.93 per mile, down 13 cents

Nogales falls back

Nogales, Ariz., a major point of origin for Mexican imports, and a big gainer the previous week, saw lane-rates drop significantly.

- Nogales-Dallas: $2.51 per mile, down 86 cents.

- Nogales-Brooklyn: $2.56 per mile, down 51 cents.

- Nogales-Los Angeles: $2.53 per mile, down 47 cents.

Expect to see volumes trend at lower levels until produce season breaks in Southern California, Florida, and across the Sunbelt.

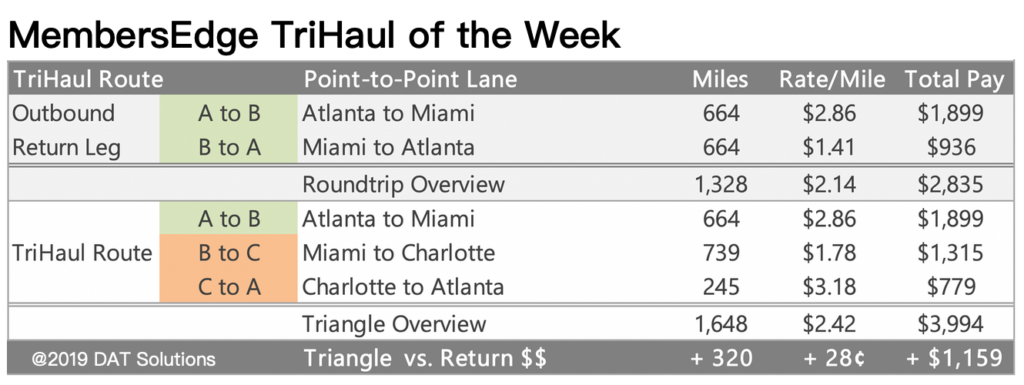

Tri-haul of the week

Atlanta-Miami-Charlotte-Atlanta

Winter is a tough time for truckers who want to leave Florida. If you’ve been around the block you know that a spot reefer load from Atlanta to Miami generally needs to pay well because the trip north may involve some deadheading.

So why not check out your tri-haul options?

Reefer freight from Atlanta to Miami paid an average of $2.86 per mile last week; the return was $1.41 per mile. A better option during first full work week of 2019: take a load from Miami to Charlotte instead, where the reefer rate averaged $1.78 per mile.

Charlotte to Atlanta averaged $3.18 per mile last week; while the third leg would add about 320 miles, not counting any deadhead, you could gain nearly $1,200 in revenue just by negotiating the average rate on each leg of the trip.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.

For the latest spot market load availability and rate information, visit the MyMembersEdge.com load board or tune in to Land Line Now. You can get all of the latest rate information at dat.com per industry-trends per trendlines, comment on the DAT Freight Talk blog, or join us on Facebook. On Twitter you can tweet your questions to us @LoadBoards and have your questions answered by DAT industry analyst Mark Montague.