Freight rates near the bottom; trailer sales down

Reports on U.S. freight market and trailer sales from ACT Research present some sobering but heartening prospects.

As far as the freight market is concerned, ACT Research reports that, while it clearly remains weak, there is a glimmer of light at the end of the tunnel.

“ACT sees the tightly intertwined supply and demand dynamics in the freight market beginning to recover with demand fundamentals improving and capacity starting to tighten,” the company predicts.

Freight demand is near the bottom, Tim Denoyer, ACT Research vice president and senior analyst said in a blog post. The blog post draws on information from the company’s monthly Freight Forecast report.

A late produce shipping season has contributed to the lack of demand, and the freight market is likely passing the peak of inventory destocking, ACT noted.

“With inflation easing, improving real income trends will allow for a bit more holiday spending this year, when even less destocking will mean more freight volume,” Denoyer said in the blog post.

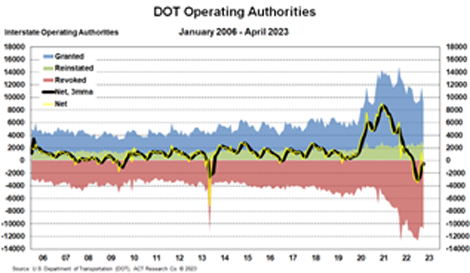

Another factor that will eventually boost freight rates is that fleet capacity is contracting at a record rate, he added.

“Interstate operating authorities are contracting at a record rate, with about 11,000 net revocations since last October, including about 1,600 net revocations in April,” Denoyer said. “Total revocations were about 10,800 in April, near record levels, though grants and reinstatements are also elevated. This is beginning to tighten capacity, which will also help spot rates find the bottom and begin to rise.”

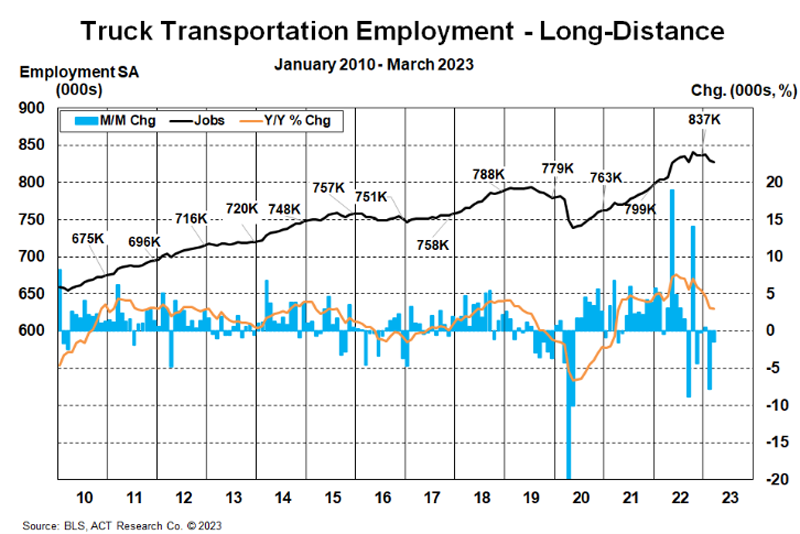

Long-distance trucking employment also is contracting, ACT Research reports. Long-haul trucking jobs dropped 1% in the first quarter of 2023, with 8,700 jobs lost. Although still up 3% year over year, the latest March data point will be down on a year-over-year basis by June.

“The intersection of additional volume and tightening capacity underpins our forecast for a near-term bottom in spot truckload rates,” Denoyer said. “We’ve been expecting the bottom roughly around this month since we introduced 2023 spot rate forecasts 16 months ago, and we still think Roadcheck this week will help usher in a new freight cycle.”

Trailer orders decline

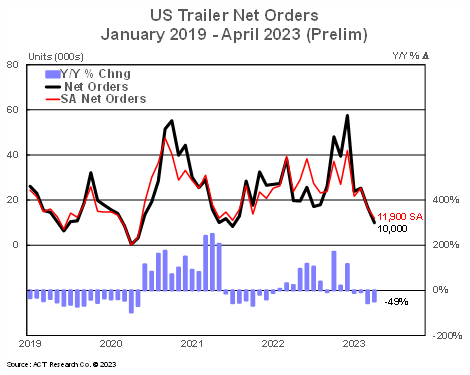

April’s preliminary net trailer orders decreased significantly from March and are even more significantly lower compared to a year ago, ACT reports

“Preliminary net orders were 41% lower compared to March’s intake, and down 49% versus the same month last year,” Jennifer McNealy, director of commercial vehicle market research and publications at ACT Research, said in another blog post. “Seasonal expectations called for orders to pull back in April, particularly given the near record-level order backlogs and supply-chain challenges being experienced by the industry.”

Demand for new trailers appears to be softening though the last month and last year numbers were particularly robust, she said. Even with the decline in demand, the order backlog is noteworthy.

“For the time being, the industry is still wrestling with lingering supply-chain challenges, although signs of improvement are seen monthly, and fleets needing trailers remain in queue for orders already placed, with backlogs for most trailer categories still near the top of their target ranges,” McNealy said.

ACT Research expects the trailer backlog should decrease by around 16,500 units to about 213,000 units when complete April data are released. The data comes from the company’s State of the Industry: U.S. Trailers report.

Supply chain issues continue to affect the freight market and new trailer sales, ACT reports.

Columbus, Ind.-based ACT Research, founded in 1986, publishes commercial vehicle truck, trailer, and bus industry data, market analysis, and forecasts for the North American and Chinese markets.