Spot market anything but flat for flatbed haulers

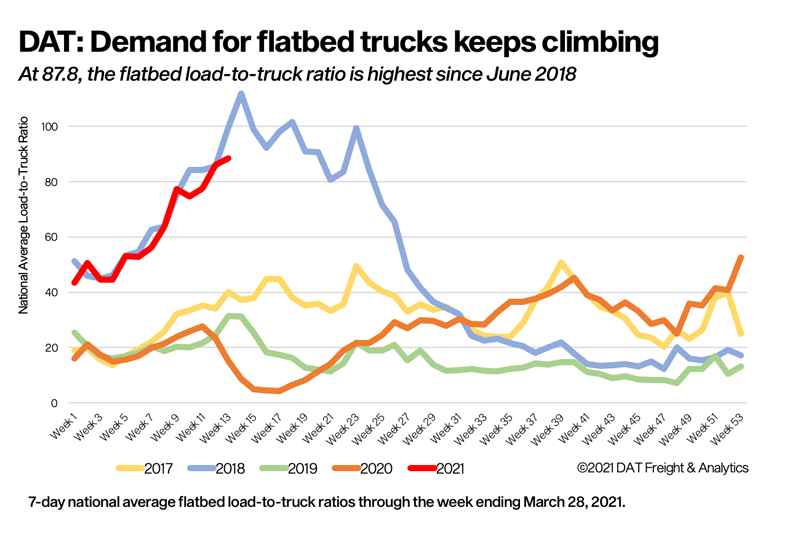

High demand to move construction and industrial loads last week pushed the national average spot flatbed rate on MembersEdge to just a few pennies shy of the record set in June 2018. At 87.8, the national average flatbed load-to-truck ratio is at its highest point in nearly three years.

Overall demand on the spot market continued to level out. The total number of van, reefer and flatbed loads posted was up 2.5% while the number of trucks fell 1%. Rates remained high but showed little movement compared to the previous week as shippers pushed freight off the docks before closing the first quarter of 2021.

National average spot rates, March

- Van: $2.66 per mile, 24 cents higher than the February average.

- Flatbed: $2.75 per mile, 19 cents higher than February.

- Reefer: $2.94 per mile, 25 cents higher than February.

These are national average spot truckload rates for the month through March 28 and include a calculated fuel surcharge. The national weekly average price of on-highway diesel was unchanged last week at $3.19 a gallon.

Trends

Flatbed capacity is tight

Flatbed capacity is tight as drivers shift toward the higher pay, better per-mile rates and comparatively lower physical demands of hauling van and refrigerated freight. With produce season around the corner, expect flatbed capacity to become even more scarce. The average spot rate increased on 40 of DAT’s top 78 flatbed lanes by volume, and the number of loads moved on those lanes was up 4.8% compared to the previous week.

Flatbed lanes to watch

The country’s high-volume flatbed lane last week was Houston to Fort Worth, Texas, averaging $2.80 a mile, up 3 cents week over week. The return paid $2.44 a mile. The number of loads moved from Lakeland, Fla., to Miami was down 16.8% last week compared to the first week of March, but the average rate was 5 cents higher at $3.17. The lane with the biggest average price jump was Roanoke, Va., to Harrisburg, Pa., at $4.11 a mile, up from $3.73. Volumes were low, however.

Van volumes rise at the end of Q1

Typical for the end of a quarter, spot van freight volumes increased last week. The number of loads moved on DAT’s top 100 van lanes was up 6% while the rate was lower on 47 of those lanes and neutral on 34, continuing a pattern of softer pricing. The national average van load-to-truck ratio increased slightly from 4.8 to 5.1.

Van lanes to watch

The Port of Los Angeles is urging shippers to focus on shorter dwell times after processing almost 800,000 20-foot equivalent units in February, a 47% gain compared to February 2020 and the seventh straight month of year-over-year increases. The average dwell time is between four and five days. Los Angeles outbound spot van rates averaged $3.24 a mile last week, down 2 cents on a 7.2% surge in the number of available loads. Los Angeles to Stockton, Calif., dipped 3 cents to $3.57 a mile last week—the return paid $1.84.

Little change in reefer demand

The number of loads moved on DAT’s top 72 reefer lanes by volume last week rose 4.4% compared to the previous week, with the average rate higher on 27 of those lanes, neutral on 13, and lower on 32. Overall, the number of reefer loads and trucks posted was virtually unchanged from the previous week.

Reefer lanes to watch

Spot reefer rates from McAllen, Texas, averaged $2.89 a mile last week, up 11 cents versus the previous week. Key lanes to watch include McAllen to Elizabeth, N.J., at $3.08 per mile, up 21 cents week over week; McAllen to Atlanta up 17 cents to $3.24 a mile; and McAllen to Dallas 9 cents higher at $3.13.

National average rates are derived from DAT RateView, a database of $110 billion in actual market transactions each year. Get the latest spot pricing information at DAT.com/Trendlines or take a deeper dive with Market Insights at DAT.com/blog.

Stay safe, and thank you for your hard work. LL