Reefers appear to be moving … to spot van freight

If you’ve wondered how one “down” segment of the truckload freight economy can affect the others, look no further than refrigerated carriers and the current state of produce harvests.

With production relatively stagnant in early April, more reefer carriers are likely competing for spot van freight. The extra capacity on DAT MembersEdge means we’re seeing marginal van and reefer rate movement on a national level.

National average spot rates through April 7

- Van: $1.86 per mile, 1 cent higher than the March average.

- Reefer: $2.17 per mile, same as the March average.

- Flatbed: $2.40 per mile, 6 cents higher than March.

Compared to the previous week, the number of load posts on DAT MembersEdge was down 2% during the week ending April 7 while truck posts increased 9%. Load-to-truck ratios slipped lower for vans and reefers while the ratio was unchanged for flatbeds.

Diesel prices increased a penny to $3.09 per gallon.

Van trends

Van volumes were down last week compared to the week before—not unusual for early April, since there was extra activity in late March for the close of the first quarter. There are actually more van loads moving on the spot market compared to this time last year.

But there are also plenty of trucks available. Rates rose on just 38 of the top 100 van lanes on DAT MembersEdge last week, while 58 fell and four were unchanged.

Where rates are rising

No lanes in the top 100 rose by more than 10 cents per mile, although several notable ones were close.

- Memphis to Columbus increased 9 cents to $1.96 per mile.

- Los Angeles to Atlanta added 8 cents to $1.58 per mile.

Where rates are falling

Rates have been weak in the Northeast, particularly outbound from Buffalo and Philadelphia. Just a handful of van lanes fell more than 10 cents per mile, but they include two lanes worth watching.

- Columbus to Memphis, a big retail-freight lane, fell 14 cents to $1.70 per mile.

- Houston to Oklahoma City, which jumped two weeks ago, fell back 12 cents to $1.92 per mile.

Reefer trends

Rates have been volatile on individual reefer lanes but the national average was unchanged last week. On the top 72 reefer lanes, rates on 36 were up, 33 were down, and three stayed the same.

For the entire U.S., reefer volume fell 1% but expectations are increasing with spring weather.

Where rates are rising

In Florida, Miami outbound volumes jumped 23% last week and were nearly 9% higher from Lakeland. But the Miami market (South Florida) had lots of trucks, which kept rates from rising, while Lakeland to Atlanta jumped 23 cents to $1.66 per mile.

In the Midwest, rates were higher from Chicago, but Grand Rapids had the biggest outbound rate increase. Grand Rapids to Atlanta surged 44 cents to $2.95 per mile.

Tri-haul of the week

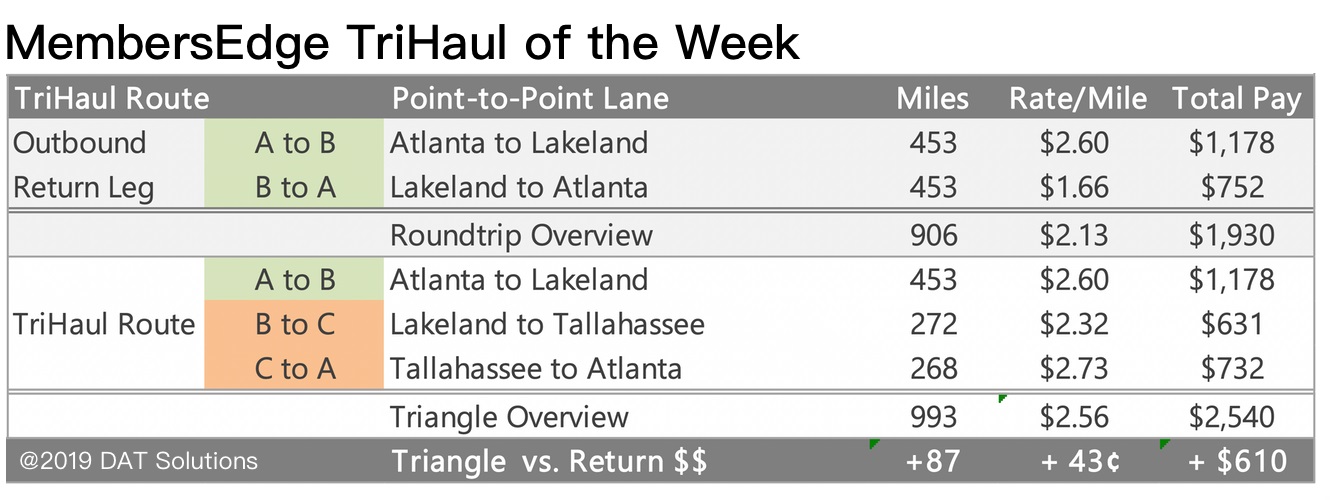

With reefer freight volumes increasing out of Lakeland but lagging elsewhere, let’s look at a tri-haul to maximize your profits. Atlanta to Lakeland paid an average of $2.60 per mile last week while the return trip paid just $1.66 per mile. If you click on the tri-haul function in DAT MembersEdge, one of the options you get is a tri-haul through Tallahassee.

Lakeland to Tallahassee averaged $2.32 per mile last week, while Tallahassee to Atlanta was $2.73 per mile. That tri-haul route only adds 87 miles but would increase your rate per loaded mile by 43 cents. The straight roundtrip paid a total of $1,930 last week but the tri-haul paid $2,540, putting an extra $610 in your pocket.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.

For the latest spot market load availability and rate information, visit the MyMembersEdge.com load board or tune in to Land Line Now. You can get all of the latest rate information at dat.com per industry-trends per Trendlines, comment on the DAT Freight Talk blog, or join us on Facebook. On Twitter you can tweet your questions to us @LoadBoards and have your questions answered by DAT industry analyst Mark Montague.