Why it looks like spot rates have touched bottom

The overall number of loads on DAT MembersEdge fell 6 percent last week, and spot van and reefer rates slipped again.

But there are reasons to think that rates have touched bottom after a seasonal slide.

February van volumes are almost 10 percent higher year over year, and, even though van rates were weaker as a national average, they stayed constant in core lanes from top markets last week.

Diesel prices, a big factor in spot rates, have been holding in the $2.96 to $3 a gallon range for the past three weeks, halting a four-month, 40-cent skid.

More volume, strong high-traffic lane rates, and stable diesel prices are good signs. Plus, it’s spring. Between retail shipments, produce harvests and construction season kicking in, it’s about time for spot rates to turn up.

Van trends

The number of van load posts was down 6 percent compared to the previous week, and truck posts were up 4 percent. National averages:

- Load-to-truck ratio: 4.3 van loads per truck.

- Spot van rate: $1.89 per mile, down 1 cent.

Better than it looks

Spot van rates as a national average are about 3.6 percent lower compared to January and down 10.6 percent from February 2018. And, of the top 100 van lanes by volume, pricing fell on 64 lanes. Yet van freight volume jumped 13.3 percent from January to February, the biggest January-to-February increase in four years.

Strong volumes and stable rates on key individual lanes continue to suggest that spot van rates are bottoming out.

Situation normal

Ocean freight should start to hit U.S. shores in advance of the spring retail season. With the next round of tariffs postponed, we may see at least a normal seasonal uplift.

Flatbed trends

The number of flatbed load posts fell 5 percent and truck posts were up 2 percent last week.

- Load-to-truck ratio: 25.1 flatbed loads per truck, down from 27.

- National average spot flatbed rate: $2.34 per mile, up 1 cent—the first increase in six weeks.

Reefer trends

The number of reefer load posts was down 5 percent and truck posts were up 1 percent.

- Reefer load-to-truck ratio: 5.5 reefer loads per truck.

- National average spot flatbed rate: $2.22 per mile, down 1 cent

Failure to launch

Among the top 72 reefer lanes last week, rates on 26 lanes were up, 44 lanes were lower, and two were neutral.

Los Angeles and McAllen, Texas, both saw a rebound in reefer freight volumes but losses elsewhere help push spot rates lower for the fifth straight week.

Volumes in this segment have fallen 3.1 percent in the last month.

Bright spots

A few reefer lanes paid better last week, including:

- Denver to Houston jumped 28 cents to $2.21 per mile.

- McAllen, Texas, to Atlanta added 25 cents to $2.46 per mile.

- Lakeland, Fla., to Charlotte gained 19 cents to $1.65 per mile.

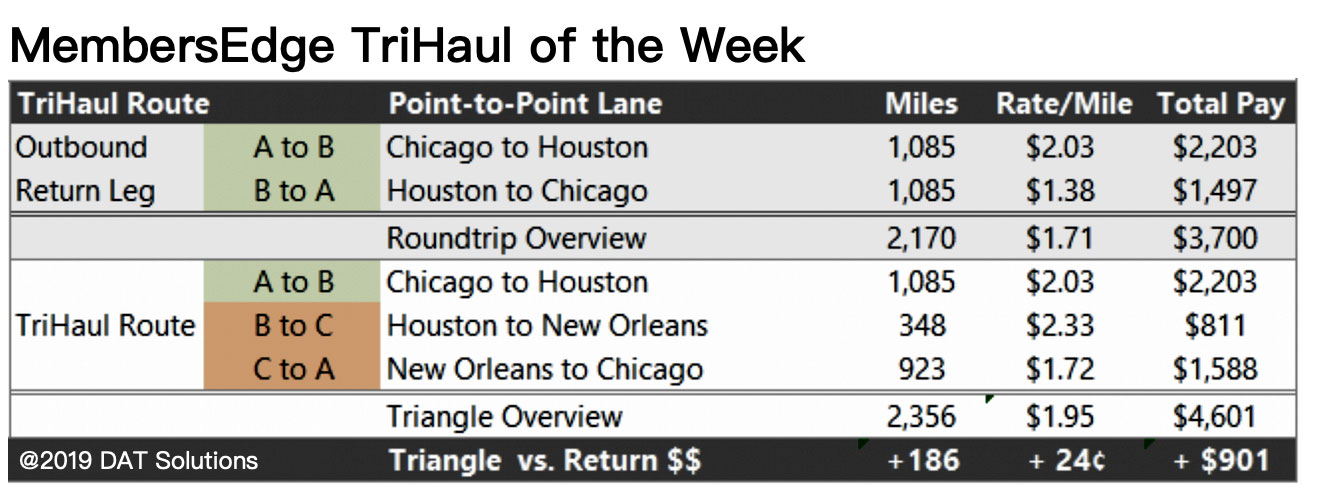

Tri-haul of the week

Chicago-Houston-New Orleans-Chicago

Outbound van rates from Chicago fell 5 cents to an average of $2.30 per mile last week. Chicago to Houston paid even lower at $2.03 per mile, and the return trip was just $1.38 per mile.

But if you gotta go, you gotta go. And a tri-haul could boost that rate.

Instead of heading straight from Houston to Chicago, you could take advantage of Houston to New Orleans (Mardi Gras freight?), which increased 12 cents to $2.32 per mile last week. New Orleans to Chicago paid an average of $1.72 per mile.

This tri-haul would boost your revenue by nearly $900 compared to the regular roundtrip while adding about 186 miles, not counting deadhead.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.

For the latest spot market load availability and rate information, visit the MyMembersEdge.com load board or tune in to Land Line Now. You can get all of the latest rate information at dat.com per industry-trends per Trendlines, comment on the DAT Freight Talk blog, or join us on Facebook. On Twitter you can tweet your questions to us @LoadBoards and have your questions answered by DAT industry analyst Mark Montague.