Weather disrupts the spot rate forecast

Just when spot rates seemed ready for an upward swing, they took another hit last week. Once again, weather was a factor.

Snow in the Rockies closed I-25, I-70 and I-76. Historic flooding in Nebraska and Iowa shut down I-80. Near Amarillo, Texas, 80-mile-an-hour winds toppled tractor-trailers as they moved down the highway.

With disruptions on so many vital truck routes, it’s notable that the number of load posts on DAT MembersEdge increased 3.5 percent compared to the previous week. Truck posts, however, gained 3.4 percent, which left van and reefer load-to-truck ratios slightly weaker:

National average load-to-truck ratios:

- Van: 1.6 loads per truck, virtually unchanged.

- Reefer: 2.9 loads per truck, down from 3.5.

- Flatbed: 22 loads per truck, up from 20.

National average spot truckload rates:

- Van: $1.86 per mile, down 2 cents.

- Reefer: $2.19 per mile, down 2 cents.

- Flatbed: $2.34 per mile, unchanged.

Van trends

Van volumes remain ahead of March 2018 but last week were no better than February. With capacity abundant, rates started to wander. On the top 100 van lanes last week, pricing fell on 53 and rose on 36. Eleven lanes were neutral.

Where rates are rising

Road closures isolated Denver last week. That led to an 18-cent increase to $1.90 per mile on the lane from Seattle to Salt Lake City. Seattle to Eugene, Ore., gained 13 cents to $2.65 per mile.

Where rates are falling

Freight volumes are building in Los Angeles, which causes inbound rates to fall, especially on intermodal-competitive lanes as railroads seek to reposition equipment to the West Coast. As a result, several van lanes to Los Angeles declined last week. Among them:

- Dallas to Los Angeles fell 19 cents to $1.27 per mile.

- Chicago to Los Angeles dropped 14 cents to $1.48 per mile.

Reefer trends

The national average spot reefer rate has declined in seven of the last eight weeks. On the top 72 reefer lanes, 26 lanes moved up while 43 lanes fell and three were neutral. We’re waiting on California and Florida produce to pull rates higher.

Where rates are rising

Out west, Sacramento to Salt Lake City jumped 40 cents to $2.35 per mile, possibly due to trouble getting into Denver. In the Midwest, two lanes from Grand Rapids rebounded from last week:

- Grand Rapids to Madison, Wis., increased 22 cents to $2.58 per mile.

- Grand Rapids to Atlanta added 21 cents to $2.71 per mile.

Where rates are falling

Many of the prior week’s gainers came back to earth, including Elizabeth, N.J., to Boston (down 38 cents to $3.81 per mile) and Philadelphia to Miami (off 22 cents to $1.96 per mile).

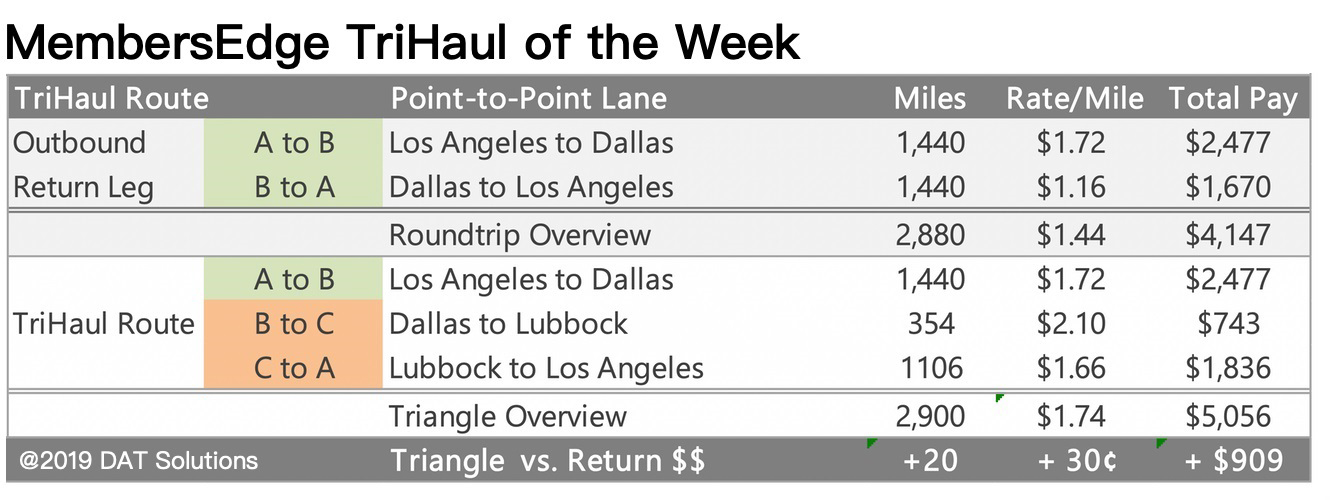

Tri-haul of the week

Los Angeles-Dallas-Lubbock-Los Angeles

If you’re hauling van freight from Los Angeles to Dallas, you can use the tri-haul option on MembersEdge to get back to L.A. without losing your shirt on this rail-competitive lane.

L.A. to Dallas averaged $1.72 per mile and just $1.16 per mile on the return last week. But Dallas to Lubbock paid $2.10 per mile and Lubbock to L.A. paid $1.66 per mile. That’s an average of $1.74 per mile, or $900 more than you’d get on the straight 2,900-mie round trip. Not bad without adding many loaded miles to your trip.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.

For the latest spot market load availability and rate information, visit the MyMembersEdge.com load board or tune in to Land Line Now. You can get all of the latest rate information at dat.com per industry-trends per Trendlines, comment on the DAT Freight Talk blog, or join us on Facebook. On Twitter you can tweet your questions to us @LoadBoards and have your questions answered by DAT industry analyst Mark Montague.