Spot volumes steady; are rates ready to spring?

After a chilly start to 2019, spot truckload volumes and rates look like they’re starting to thaw.

The number of load posts on DAT MembersEdge climbed 4 percent while truck posts fell 2 percent last week. While reefers remained in a seasonal decline, volumes rose and capacity tightened for vans and flatbeds, which elevated load-to-truck ratios in both segments.

- Van load per truck ratio: 4.8, up 4 percent.

- Flatbed load per truck ratio: 27, up 12 percent.

- Reefer load per truck ratio: 5.8, down 1 percent.

Spot rates slipped but national averages are still pretty strong for mid-February:

- Van: $1.90 per mile, down 1 cent.

- Flatbed: $2.33 per mile, down 1 cent.

- Reefer: $2.23 per mile, down 2 cents.

Van trends

Van load posts climbed 2 percent while truck posts fell by 2 percent. Volumes are firming up about a month ahead of schedule, an indication that conditions should start to improve. Hang in there.

Lucky 13

Rates rose on 47 of the top 100 van lanes last week and drifted lower on 40. Rates on the remaining 13 lanes were unchanged, a big number that signals we’re at or near the bottom for rates this winter.

Sun-less in Seattle

The Midwest and Northeast have been hammered by cold weather, but a ridiculous amount of snow snarled traffic around Seattle last week, a market that’s just not accustomed to it. At times, the weather shut down I-90, and Seattle to Spokane – a weak lane – jumped 31 cents to an average of $3.54 per mile.

Flatbed trends

Bring on construction season. The number of flatbed load posts on DAT MembersEdge was up 7 percent last week while truck posts dropped 5 percent. The flatbed load-to-truck ratio hit 27 and rates may soon firm up.

Reefer trends

The spot reefer market saw load posts fall 1 percent and truck posts hold steady last week. We’ll be watching to see if the downward trend affects van capacity–– reefer haulers sometimes turn to the spot van market to stay busy until harvest season picks up.

Wild West

It’s off season for Western reefer markets, but winter driving conditions pushed rates higher on some lanes.

- Sacramento to Salt Lake City increased 35 cents to $2.50 per mile.

- Twin Falls, Idaho, to Phoenix added 28 cents to $2.41 per mile.

Slip-sliding away

Prices dropped in the Midwest after the recent Arctic weather prompted an uptick.

- Green Bay to Des Moines fell 65 cents to $2.23 per mile.

- Grand Rapids to Cleveland declined 28 cents to $2.41 per mile, a more normal rate for that lane at this time of year.

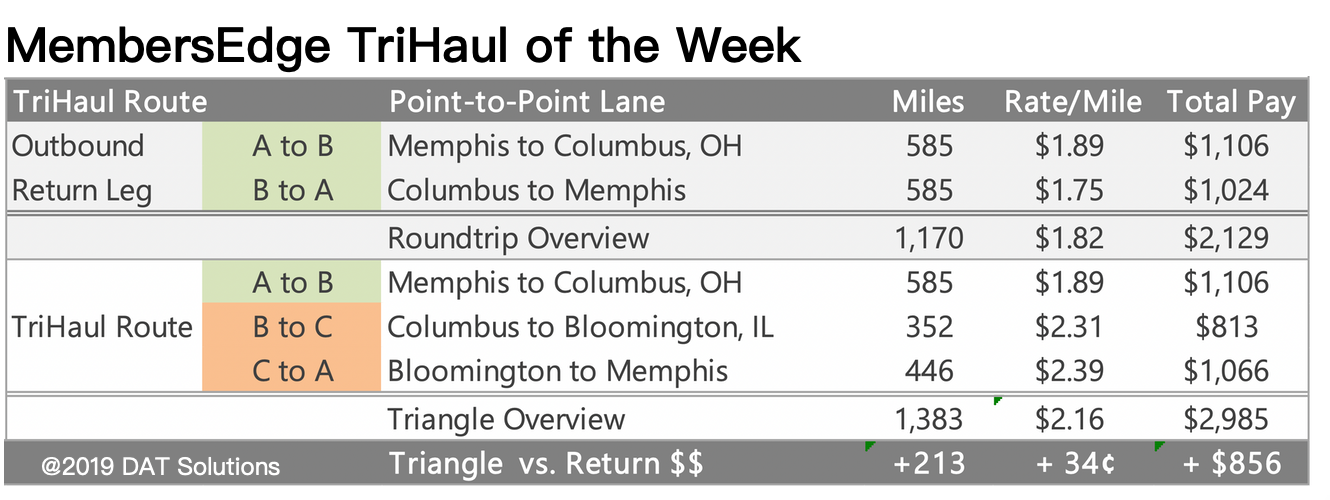

Tri-haul of the week

Memphis-Columbus-Bloomington-Memphis

Memphis and Columbus, Ohio, are often a balanced lane pair, meaning that prices are similar in each direction. But while Memphis to Columbus averaged $1.89 per mile last week, Columbus to Memphis lane was $1.75 per mile – a 14-cent spread. The $1.82 per mile average roundtrip is below the national average rate for spot van freight.

What can you do to boost that rate? Try a tri-haul.

After your Memphis-Columbus move, the rate from Columbus to Bloomington, Ind., averaged $2.31 per mile while Bloomington to Memphis averaged $2.39 per mile.

If you negotiated the average price on each leg of the trip, your rate per loaded mile for the entire tri-haul would be $2.16 per mile, 34 cents better than the straight Memphis-Columbus roundtrip.

Based on last week’s rates, this tri-haul would add about $856 in revenue and 213 miles.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.

For the latest spot market load availability and rate information, visit the MyMembersEdge.com load board or tune in to Land Line Now. You can get all of the latest rate information at dat.com per industry-trends per trendlines, comment on the DAT Freight Talk blog, or join us on Facebook. On Twitter you can tweet your questions to us @LoadBoards and have your questions answered by DAT industry analyst Mark Montague.