Spot van, reefer rates show a little life

Like green shoots coming up through the snow, national average spot van and reefer rates on DAT MembersEdge showed signs of life last week, an indication that demand for trucks is starting to build as move into spring.

But the pricing traction was not widespread. Van and reefer load-to-truck ratios declined, and better-paying freight was concentrated on a handful of lanes and regions.

Van trends

The van load-to-truck ratio was 4.2 last week, compared to 4.6 the previous week, and the national average spot van rate was unchanged at $1.88 per mile.

Pockets of pricing power

While spot van volumes are nearly identical to this time last year, only 26 of the top 100 van lanes saw rates rise last week; 59 lanes were lower and 15 were neutral.

Texas heat

Texas freight availability is warming up with higher load-to-truck ratios and relatively solid van rates from Houston ($1.72 per mile average) and Dallas ($1.64 per mile) last week. The Dallas-to-Los Angeles lane surged 20 cents to $1.46 per mile.

Missing the boat?

We didn’t see the expected surge in freight out of California ports and warehouses last week. The average Los Angeles outbound spot van rate dipped 4 cents to $2.06 per mile.

Seattle Settles: After a stratospheric few weeks, van pricing out of Seattle parachuted downward. Seattle to Salt Lake City fell 12 cents to $1.72 per mile, and Seattle to Spokane dropped 11 cents to $3.27 per mile.

Reefer trends

The national average reefer rate on DAT MembersEdge actually ticked up a cent to $2.21 per mile, but read on: we’re still in a seasonal lull. The reefer load-to-truck ratio was 5.6 last week, down from 6.0.

Still waiting

On the top 72 reefer lanes last week, rates on 29 lanes moved higher while 40 lanes declined and three were neutral. Volumes were down only slightly from the previous week, but they’re not yet on the rise except for a few areas where produce season is kicking in.

Top producers

Average outbound rates increased in Fresno, Calif., and McAllen, Texas, two of the nation’s top produce markets. Reefer lanes with big price increases included McAllen to Dallas, up 23 cents to $3.03 per mile, and Fresno to Denver, up 9 cents to $2.45 per mile.

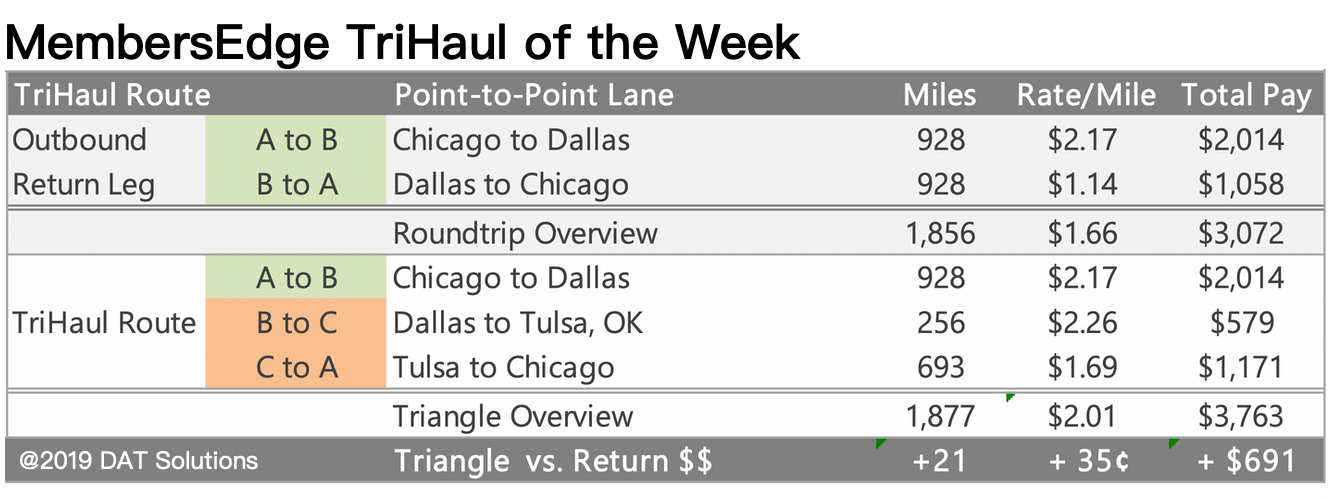

Tri-haul of the week

Chicago-Dallas-Tulsa-Chicago

It’s a good time to get in on the action in Texas. Chicago to Dallas averaged $2.17 per mile last week, but the return was just $1.14 per mile. You can take advantage of one of the hotter lanes out of Dallas and turn the roundtrip into a tri-haul.

Dallas to Tulsa paid an average of $2.26 per mile last week while Tulsa to Chicago averaged $1.69. If you can make it work with your schedule and hours of service, this tri-haul suggestion in DAT MembersEdge would boost your average rate per loaded mile from $1.66 to $2.01. That’s almost $700 in more revenue without adding a lot of distance compared to the straight roundtrip.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.

For the latest spot market load availability and rate information, visit the MyMembersEdge.com load board or tune in to Land Line Now. You can get all of the latest rate information at dat.com per industry-trends per Trendlines, comment on the DAT Freight Talk blog, or join us on Facebook. On Twitter you can tweet your questions to us @LoadBoards and have your questions answered by DAT industry analyst Mark Montague.