Spot rates on DAT MembersEdge higher but the pace has slowed

Demand for trucks on DAT MembersEdge was higher and national average spot rates stayed elevated last week as the number of loads posted was nearly unchanged compared to the previous week. The number of available trucks declined 2.6%.

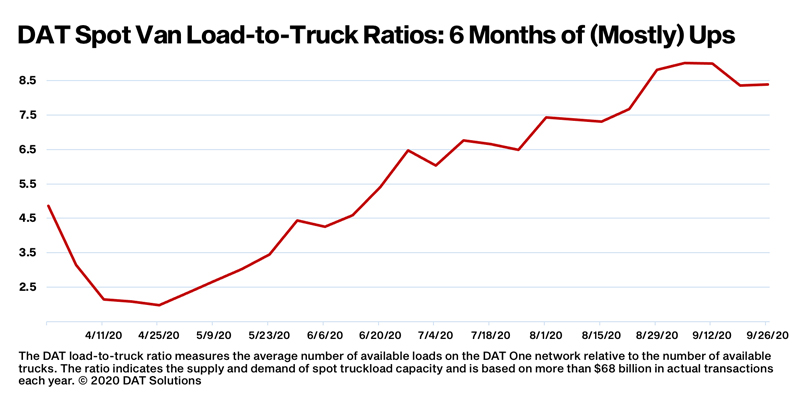

Spot rates are exceptionally strong for September, but after five months of increases there are signs that the pace is slowing.

National average spot truckload rates, September

- Van: $2.37 per mile, unchanged compared to the previous week.

- Flatbed: $2.40 per mile, up 1 cent.

- Refrigerated: $2.57 per mile, unchanged.

These rates are rolling averages for the month through Sept. 27 and include a fuel surcharge.

Trends to watch

- The average spot rate was higher on 29 of DAT’s top 100 van lanes by volume compared to the previous week. Thirty lanes were neutral and 41 saw rates decline. The number of available loads on these lanes was almost the same week over week.

- At $2.37 per mile, the national average spot van rate was 14 cents higher than the national average contract rate last week. The national average van load-to-truck ratio was 5.3, equal to the August average.

- Load board volume last week was 22% higher in Florida and Gulf Coast markets as freight patterns return to normal after a period of disruptive weather. In California, volumes in Ontario and Los Angeles posted a 16% week-over-week increase, while San Francisco volumes climbed 18%. Houston reported the largest gain among major van markets with a 30% increase in outbound load posts.

- Average rates last week jumped on key lanes for retail freight, including from Philadelphia to regional warehouse markets. Philadelphia to Buffalo rose 15 cents to $3.45 per mile, Philadelphia to Charlotte was up 11 cents to $2.38, and Philadelphia to Columbus climbed 9 cents to $2.25.

- At $2.57 per mile, the national average spot reefer rate is at its highest level in five years for September. Among DAT’s top 72 reefer lanes by volume, there was an even split: 24 were up, 24 down and 23 unchanged. The number of loads moved on those 72 lanes increased 4.8% compared to the previous week.

- Spot reefer rates tend to fall at this time of year on declining volumes of fresh produce. The average outbound rate from Philadelphia, a major distribution hub, is down 11% month over month. Avocados in South Florida are in peak season, and load posts out of Lakeland and Miami are up 8% week over week.

- Produce volumes are building out West and especially in southern Idaho, where the spot reefer rate from Twin Falls to Los Angeles and Twin Falls to Chicago both averaged $2.27 per mile last week.

- On the strength of construction materials, volumes increased 3.8% on DAT’s top 78 flatbed lanes last week. The average rate increased on 46 of those lanes compared to the previous week, while 13 lanes were lower and 18 unchanged.

These rates represent averages from last week and this week will be different. Negotiate the best deal you can get on every haul, and look at the rates and load-to-truck ratios in MembersEdge to understand which way the rates are trending.

For the latest spot market updates related to COVID-19, visit DAT.com/industry-trends/covid-19 and follow @LoadBoards on Twitter. You can post comments on the DAT Freight Talk blog or on the DAT Facebook page. You can listen to the DAT MembersEdge report every Wednesday on Land Line Now. If you’re a company driver, DAT has a free app called DAT Trucker. It shows where to find fuel, truck stops, weigh stations, Walmart stores, and other important locations while you’re on the road. It’s in Google Play or Apple’s App Store.

Stay safe, and thank you for your hard work. LL