Spot rates fall as load posts decline 11%

Spot rates softened after a solid start to May as the number of load posts on DAT MembersEdge fell 11% last week and truck posts increased 5%.

Load-to-truck ratios were lower for all three equipment types. These trends are running counter to what we expect to see during the second week of May, when spot rates and volumes typically begin to build.

National average spot rates through May 12

- Van: $1.81 per mile, same as the April average.

- Reefer: $2.19 per mile, 4 cents higher than April.

- Flatbed: $2.33 per mile, 1 cent lower than April.

The price of diesel fuel fell 1 cent to $3.16 per gallon as a national average.

Van trends

The number of van load posts plummeted 10.6% compared to the previous week, although volumes are about 3% higher year over year. The national average spot van load-to-truck ratio stepped down from 1.8 to 1.5 loads per truck last week as capacity rose 4.2%. A ratio below 1.75 generally indicates that shippers and brokers will have in-rate negotiations.

Where rates are rising

There’s not much to speak of. Los Angeles van volume was up 7.6% compared to the previous week. Warehouses in the area hold a lot of inventory from Asia, so the surge may be related to the announcement of increased China tariffs. But the average Los Angeles-outbound van rate fell 3 cents to $2.11 per mile last week.

Reefer trends

Reefer freight is gaining steam. Volume on the 72 largest reefer lanes rose 8% last week, which should have sent rates and load-to-truck ratios higher. While the national average reefer rate improved a penny, the load-to-truck ratio fell from 2.9 to 2.3 last week.

On the plus side, spot reefer volume was higher in Los Angeles (18%), Atlanta (8.8%), Chicago (13.5%), and Dallas (14.3%) compared to their previous week.

Where rates are rising

Average outbound rates increased from Fresno, Calif. ($2.23 per mile, up 3 cents); Sacramento ($2.60 per mile, up 7 cents); and Lakeland, Fla. ($2.23 per mile, up 1 cent). Rates were up on several lanes:

- Lakeland to Atlanta, up 44 cents to $2.31 per mile.

- Miami to Atlanta, up 23 cents to $2.49 per mile.

- Sacramento to Salt Lake City, up 25 cents to $2.57 per mile.

Volume and rates dropped sharply from major markets in the Midwest. Grand Rapids to Atlanta lost 82 cents to $1.97 per mile compared to the previous week.

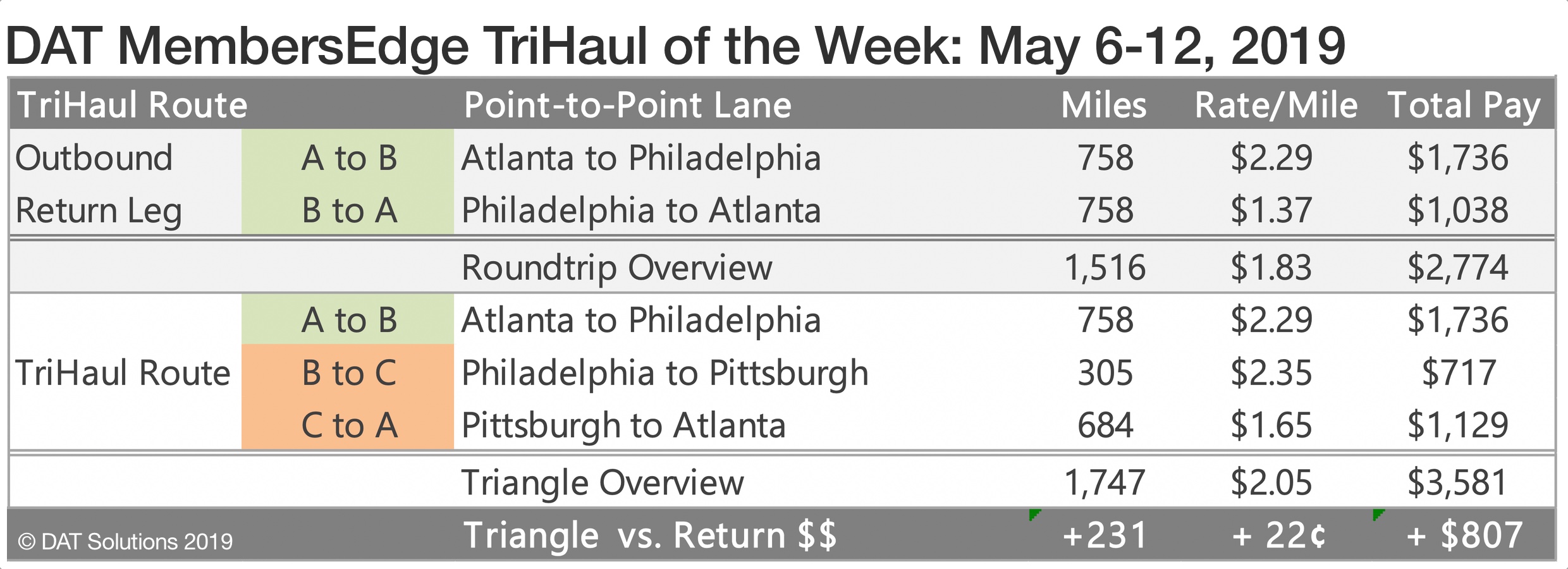

Tri-haul of the week

Atlanta-Philadelphia-Pittsburgh

Van freight from Atlanta to Philadelphia paid an average of $2.29 per mile last week—not bad. But the return to Atlanta averaged $1.37 per mile. If you click on the tri-haul function in DAT MembersEdge, one suggested route would add a stop in Pittsburgh on the way back to Atlanta and put another $807 in your pocket.

Philadelphia to Pittsburgh averaged $2.35 per mile while Pittsburgh to Atlanta was $1.65 per mile. That’s an average of $2.05 per mile with the tri-haul compared to $1.83 per mile for the straight round trip. Overall, this tri-haul would generate almost $3,600 in revenue instead of under $2,800 if you can make it work with your hours and the rest of your schedule.

These rates represent averages from last week and, as always, the rate you charge is between you and your customer.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.

For the latest spot market load availability and rate information, visit the MyMembersEdge.com load board or tune in to Land Line Now. You can get all of the latest rate information at dat.com per industry-trends per Trendlines, comment on the DAT Freight Talk blog, or join us on Facebook. On Twitter you can tweet your questions to us @LoadBoards and have your questions answered by DAT industry analyst Mark Montague.