DAT Solutions: Spot load-to-truck ratios slip, pull rates lower

The spot truckload freight market was hopping during Labor Day week as Hurricane Dorian hit the East Coast. Since the storm passed, however, so has the sense of urgency that pushed rates and volumes higher. Last week, load-to-truck ratios edged lower for vans and reefers but moved higher for flatbeds as reconstruction efforts began.

National average spot rates, September 2019 (through Sept. 8)

- Van: $1.85 per mile, 4 cents higher than the August average.

- Flatbed: $2.19 per mile, 1 cent lower than August.

- Reefer: $2.18 per mile, 4 cents higher than August.

Van trends

The van load-to-truck ratio averaged 2.4 last week, and rates were higher on 35 of the top 100 biggest van lanes by volume. Fifty-four lanes fell, and 11 were unchanged compared to the previous week.

Where rates were up

Rates were higher in the Pacific Northwest, thanks to rising imports and a strong fall harvest. The average outbound spot rate from Seattle increased 3 cents to $1.54 per mile, with the lane to Eugene, Ore., and Medford, Ore., up 19 cents to $2.72 per mile, one of last week’s biggest gainers. Portland, Ore., to Stockton, Calif., added 11 cents to $1.41 per mile.

Flatbed trends

Spot flatbed freight activity rose as construction supplies and equipment moved into areas affected by Hurricane Dorian. The national average flatbed load-to-truck ratio was 14.4, up from 12.7 the previous week.

Where rates were up

Even before the attacks at the Saudi Aramco oil facility last weekend, there was a surge in flatbed freight volume from Houston, a major supplier of freight to West Texas and the Permian Basin. The average outbound flatbed rate increased just a penny to $2.38 per mile last week, but freight volume from Houston jumped 67% and the lane from Houston toward El Paso, Texas, more than doubled.

Increased volume in the wake of Hurricane Dorian pushed several Southeast markets higher, led by Tampa, Fla., ($1.72 per mile, up 7 cents) and Birmingham, Ala. ($2.44 per mile, up 9 cents). Together, flatbed trends in the Southeast and Texas suggest better times ahead.

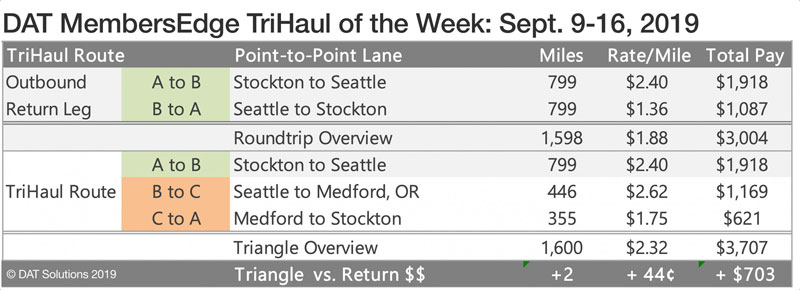

Tri-haul of the week

With harvests coming in, the West has been a reliable source of reefer loads. Stockton to Seattle averaged $2.40 per mile last week but the return paid $1.36. That’s an average of $1.88 a mile for the 1,598-mile round trip.

Instead of going straight back to Stockton, let’s add a leg to Medford (which includes some of Northern California). At 16.6, Medford had one of the highest load-to-truck ratios in the country last week, with 800 load posts and only 48 truck posts.

Seattle to Medford averaged $2.62 per mile, and Medford to Stockton was $1.75 per mile. Adding that third leg means you would average $2.32 per mile without adding distance to your trip. The extra pick and drop would increase your revenue by $703 for a grand total of $3,707.

Remember, these rates are averages from last week, and this week could be different. Negotiate the best deal you can get on every haul, and check MembersEdge to understand which way the rates are trending.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.

For the latest spot market load availability and rate information, visit the MyMembersEdge.com load board or tune in to Land Line Now. You can get all of the latest rate information at dat.com per industry-trends per Trendlines, comment on the DAT Freight Talk blog, or join us on Facebook. On Twitter you can tweet your questions to us @LoadBoards and have your questions answered by DAT industry analyst Mark Montague.