Small verdicts costing trucking industry despite lawsuits being rare

A new report suggests that although smaller verdicts and settlements may be a factor in driving up insurance rates, only a fraction of insurance claims actually go to litigation.

On Thursday, the American Transportation Research Institute published a study titled “The Impact of Small Verdicts and Settlements on the Trucking Industry.” A follow-up to a report on nuclear verdicts released last year, ATRI’s latest study turns to the impact of verdicts and settlements below $1 million.

According to the study, the total number of small verdicts are potentially raising insurance premiums for truckers. Quickly collecting small payouts has become a booming business for plaintiff attorneys. Consequently, that can increase operational costs, which can trickle down to consumers.

However, verdicts and settlements of any kind are rare. Additionally, the price tag of the average verdict under $1 million is trending downward.

Small verdicts are big business

The sheer number of payouts, rather than the size, may be driving up insurance rates. Going after truckers following a relatively minor crash has become an entire industry itself.

Specifically, ATRI refers to “ambulance chaser” attorneys who go after potential clients not long after a crash. Pursuing baseless litigation is a breach of the American Bar Association’s professional responsibility rules. Although several states have made the practice illegal, proving that breach can still be difficult.

Attorneys also operate “settlement mills,” which is a business model based more on volume. These firms can have hundreds of open cases at any given time. The idea is to get a settlement as quickly as possible. Although single payouts are low, hundreds of small verdict payouts can be big money.

There is also something called “litigation financing,” which is a third party that pays for litigation costs in exchange for a share of the payout. According to ATRI, the number of companies adopting this new business model has grown by more than 400%. Similarly, third parties are purchasing a plaintiff’s medical bill in expectation of a court payout.

All of these financial incentives encourage litigation, even for small verdicts or settlements, and inflates medical costs, according to ATRI. Consequently, insurance rates can increase.

“The proliferation of lawsuits put motor carriers in a pernicious cycle: insurance rates spike as plaintiff payments grow in size or number,” the report states.

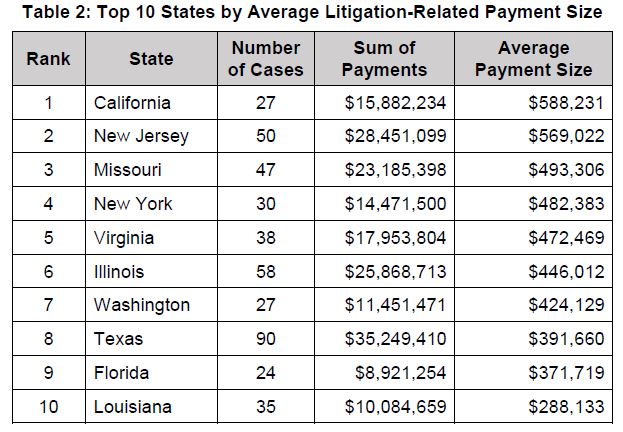

Some states are worse than others when it comes to verdicts and settlements. Deemed “judicial hellholes” by the American Tort Reform Foundation, some states are considered unfavorable to defendants. These determinations are based on jury verdicts, court decisions, judicial rules and legislative action. California is the most unfavorable, with an average “small verdict” of $588,231.

Texas may no longer be on that list for the trucking industry. Earlier this year, the Lone Star State enacted a law that lawmakers say levels the playing field in commercial liability cases. Land Line’s State Legislative Editor Keith Goble reports the law, which went into effect in September, “protects trucking companies from frivolous lawsuits in instances where the driver was not negligent.”

Crash lawsuits are rare

Despite the fact that even small verdict cases are lucrative for attorneys, the overwhelming majority of reported claims do not go to the courtroom.

ATRI states that less than 2% of reported insurance claims generate any litigation action. In other words, insurance companies take care of most crash-related disputes without the need for litigation. This backs up data that suggest less than 1% of truck-involved crash cases exceed $750,000, which is the current insurance minimum.

U.S. House Rep. Jesus Chuy Garcia, D-Ill., tried to increase insurance minimums to nearly $5 million earlier this year. Garcia’s minimum insurance increase would have been indexed to inflation, which has not been done since the minimum was created in 1980. The move was seen by many as an attempt to line the pockets of ambulance chasers and settlement mills.

However, data show that not only are lawsuits extremely rare, but the current minimum is still relevant. A 2014 federal study found that the current minimum insurance level adequately covered damages in all but 0.6% of the cases.

Additionally, ATRI’s report shows that total litigation-related payments are trending downwards. Although the case is debatable, the study cites one insurance professional claiming a recent decline in the incident-per-truck rate (crashes per 100 trucks).

Verdicts versus settlements

ATRI’s report discovers there are significant differences between small verdicts and small settlements. Additionally, certain injuries yield higher payouts.

According to the data, settlements results in higher payouts. Nearly twice as many settlements are worth more than $800,000 compared with jury verdicts. In fact, nearly 60% of settlements are $400,000 or more, compared with only 39% of verdicts. The majority of small verdicts under $100,000 were with verdicts.

Although the payouts are more for settlements, overall legal costs are likely higher for verdicts. Attorney fees greatly reduce the final payout in verdicts. Conversely, litigation costs for settlements are much lower. Therefore, settling can prove to be more cost-efficient went accounting for legal fees.

There’s also a difference between court venues. In state courts, more than half of cases reach a settlement. However, nearly two-thirds of cases come to a jury verdict in federal lawsuits. In terms of money, a state lawsuit is twice as likely to have an overall payout of more than $800,000. On the other hand, it is also more likely that a state court will yield a very small payout as well.

Injury types also play a role. Essentially, the more severe the injury, the more likely it is a settlement will be reached. LL