Report suggests how Florida can move from fuel tax to per-mile fee

Should Florida completely replace the fuel tax with a vehicle miles traveled charge? According to a Florida think tank, the answer to that question is a resounding yes, and it recommends how to get there.

On July 7, the James Madison Institute, a Florida-based think tank advocating for public policy changes at the state level, published a report titled “The Road Ahead: Why Florida Should Shift from Per-Gallon Gas Taxes to Per-Mile Charges and How to Do It.” The institute, which considers itself a free-market think thank for Florida policies, breaks down why and how the Sunshine State should move from a fuel tax to vehicle miles traveled fee.

“This policy brief has argued that a transition from per-gallon taxes to per-mile charges will be necessary over the next several decades,” the report states. “It has also recommended that in designing such a program for Florida, the objective should be not merely to replace the revenue that fuel taxes traditionally provided but also to fix a number of other shortcomings of fuel taxes circa 2020. These include lack of transparency, lack of accountability of road providers to road users, and the fact that the fuel tax is a tax rather than a true user fee like utility bills.”

Decline of fuel tax revenue

Like most states across the nation, Florida is seeing a drop in fuel tax revenues as vehicles become more fuel-efficient. Stating its case, the James Madison Institute projects what the future will look like if the fuel tax remains the same.

The institute uses two national forecasts for data. The first is the Energy Information Administration’s projection of the fuel efficiency of the entire passenger vehicle fleet, as new, high-mpg vehicles become available and replace older low-mpg vehicles, between now and 2050. The other projects the market penetration of electric vehicles, developed by Bloomberg New Energy Finance, which would lead to a further reduction in gasoline gallons sold.

According to the report, the current average total state gas tax rate across all Florida counties is 36.7 cents per gallon. If fuel tax revenue remained constant, it would climb from about $4 billion today to nearly $8.5 billion in 2050. However, using the EIA’s projection, fuel revenue by 2050 drops to below $5.5 billion. Even worse, the Bloomberg numbers put fuel tax revenue in 2050 at nearly where it is today, a $4.4 billion dollar difference if fuel tax revenues remained constant.

In other words, if the state of Florida continues to rely on the fuel tax, it could see a drop in potential revenue in the billions of dollars.

“By 2035, today’s average total rate of 36.7 cents per gallon would have to be raised to 67 cents per gallon just to offset the decline from the EIA forecast, or to 75.6 cents per gallon to also offset the Bloomberg EV estimate” the report estimates. “And by 2050, those rates would need to be higher still, at 94.7 cents and $1.138 per gallon, respectively.”

Even if Florida were to bump up fuel tax rates, it still leaves electric vehicles off the hook in terms of paying for the infrastructure they use. That inequity, the report states, is one of the reasons why the state should transition to a VMT fee.

Transition to a vehicle miles traveled fee

The “why” in the vehicle miles traveled is easy to explain compared to the “how” aspect. For the James Madison Institute, the best way is to start with tolled roads and slowly branch out to open-access roadways.

Initially, the Florida Department of Transportation will study the four interstate corridors without tolls to determine a long-term rebuilding plan. This would be financed through toll revenue bonds. As each corridor reopens, all motorists would pay “per-mile tolls” instead of – not in addition to – the state fuel tax.

To calculate charges, FDOT would use the SunPass tolling system by calculating the amount of fuel each customer used driving the new corridor (based on the vehicle make and model plus its EPA highway fuel economy rating). Software would calculate rebates of the state fuel taxes that would still be in place for all other roads. Once all limited-access highways convert to the system, about a quarter of all Florida vehicle miles traveled would be under the VMT fee rather than the fuel tax.

“Starting with limited-access highways (where there are only a few places to get on and get off) means that the transition to per-mile charging can begin by making use of existing technology—the SunPass system, consisting of windshield-mounted transponders supplemented by license-plate imaging,” the report states. “This avoids the need for near-term decisions about any new technology that would be needed in cars and trucks to enable per-mile charging for open-access roadways, such as U.S. 441, U.S. 27, numerous state-numbered highways such as SR 60 and SR 80, as well as local streets.”

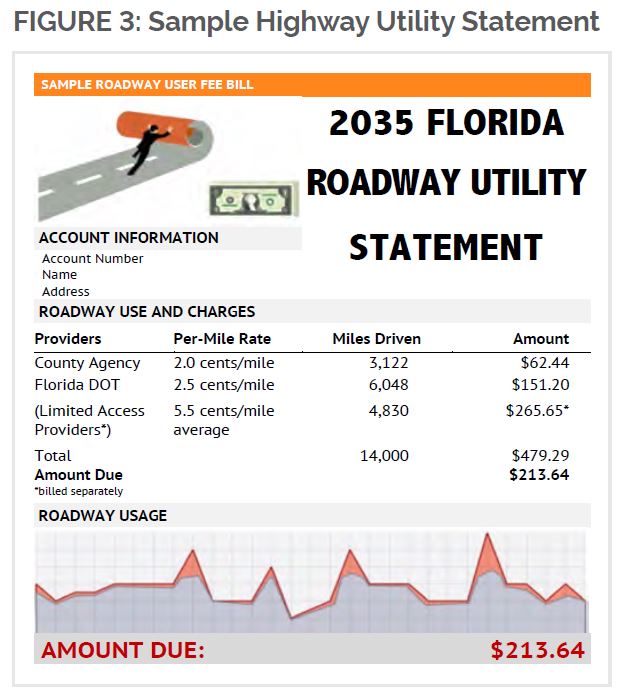

Addressing the issue of the lack of transparency with fuel taxes, the report suggests an alternative billing approach for a vehicle miles traveled fee.

Essentially, motorists will receive an annual statement similar to property tax bills.

However, an option for quarterly or monthly statements are also mentioned. Below is a sample of a VMT fee statement.

“The idea is to provide a transparent system under which roadway customers know who provides which set of roads they use, what they charge per mile traveled, and therefore what they must pay – like the utility bills everyone is familiar with,” the report states.

Public perception of VMT fee vs. fuel tax

One of the major hurdles to cross is convincing Americans that a vehicle miles traveled fee is better than a fuel tax in the long term. According to the report, only about a quarter of Americans view this idea as a good one. Concerns include “Big Brother” tracking devices, a per-mile fee on top of the fuel tax, and the idea that a per-mile fee will become a high tax to discourage driving.

Addressing tracking, the James Madison Institute states that VMT fee pilot programs in Western states did not track motorists’ locations. The report explains that the GPS on the devices only uploads mileage data, not specific location. The institute compares this to GPS on cellphones, which does track location, but that data only goes to those the user agrees to have.

As mentioned above, the report’s suggestion for a per-mile fee does not call to add it to the fuel tax.

Although the Congressional Budget Office’s analysis for a truck-only per-mile fee suggests adding it to the diesel tax, the James Madison Institute’s approach specifically states that it replaces any fuel taxes.

The Owner-Operator Independent Drivers Association is broadly opposed to truck-only vehicle miles traveled fees. In a letter to Congress in January, the Association also expressed concerns over per-mile fees in general. Those concerns include issues like the cost of equipment to establish such systems, administrative costs for highway users, and the cost of enforcement.

“While this concept may sound appealing in theory, there are far too many questions and uncertainties… to begin implementing any sort of VMT program in the next highway bill,” the Association wrote. “While we are opposed to moving forward with a VMT program in general, we are particularly concerned about proposals that would single out the trucking industry for a truck-only VMT.”

Additionally, the report points out several negative aspects of the fuel tax:

- Fuel taxes do not keep pace with roadway needs.

- They are not transparent.

- Gas/diesel taxes are a one-size-fits-all method of charging.

- Fuel taxes are no longer dedicated to user benefits.

- Fuel taxes are taxes, not true user fees.