Minnesota transportation funding plans differ on fuel tax

Multiple hearings held in recent weeks in both chambers of the Minnesota statehouse focus on an omnibus transportation finance bill. A possible fuel tax increase is included.

The House version, HF1684, would allot $6.25 billion to the Minnesota Department of Transportation over the next two years.

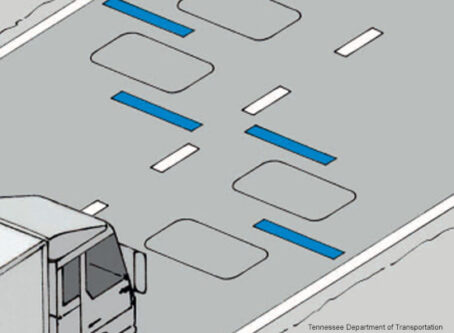

The state’s trunk highway system would receive $400 million in bonds for fiscal year 2024. About $225 million of the amount would be allotted for state road construction. The remaining $175 million would be tabbed for the state’s Corridors of Commerce program.

In place since 2013, the program is intended to boost highway capacity and improve freight movement statewide. Transportation improvements include the addition of lanes, bypasses and shoulders to essential travel corridors.

Additional revenue would come from a provision to index the state’s 28.5-cent fuel tax based on an index of construction prices. The link is expected to result in an annual increase of about a penny.

A separate provision would increase the state’s 6.5% vehicle sales tax to 6.875%. The Metropolitan Council would also impose a 0.5% transit sales tax in the Twin Cities metropolitan area.

Rep. Frank Hornstein, D-Minneapolis, is the House sponsor of the transportation bill. He says that legislators need to get a deal done that will make a dent in needs, and not settle for a short-term solution.

Additionally, the bill calls for setting a statewide goal to reduce vehicle miles driven by 20% by the year 2050.

The state also would be forbidden from suspending a person’s driver’s license solely for failure to pay a traffic ticket, parking fine, or surcharge following conviction.

No fuel tax increase

The Senate version of the proposed transportation budget is touted to address road and bridge funding needs without a fuel tax increase.

Sponsored by Sen. Scott Newsman, R-Hutchinson, SF1159 would provide $3.03 billion for state and local roads. The Corridors of Commerce would be allotted nearly twice as much as the House version – $334 million.

Funds would come from an increased share of revenue from the vehicle parts sales tax.

Currently, about 49% of the vehicle parts tax revenue is routed to roads and bridges. The amount is scheduled to be reduced by 2% annually.

The bill would instead increase to 60% the amount of vehicle tax applied for roads and bridges. A small percentage would be dedicated to small cities and townships around the state.

One reform included in the Senate version would prohibit the state DOT from converting vehicle lanes on trunk highways to bike paths or bike routes. Additionally, fuel tax revenue could not be used for projects that include bike paths.

Alternative-fuel vehicles

The Senate bill would increase surcharges on electric vehicles and hybrids.

The surcharge for electric vehicles would increase from $75 to $229. A surcharge of $114.50 would also be collected on plug-in hybrid vehicles.

Both fees would be tied to the state’s fuel tax.

“Gas taxes run the risk of being regressive, but if EV owners contribute to this fund like every other car owner already does, we can avoid that situation altogether,” Sen. Jeff Howe, R-Rockville, previously said in prepared remarks.

“Electric vehicles are heavier than their gas counterparts, and as long as they’re benefiting from state roads, they should be paying to maintain them, too.”

Path ahead

House and Senate lawmakers must reach agreement on provisions in the bill to advance a transportation finance plan to the governor’s desk. LL