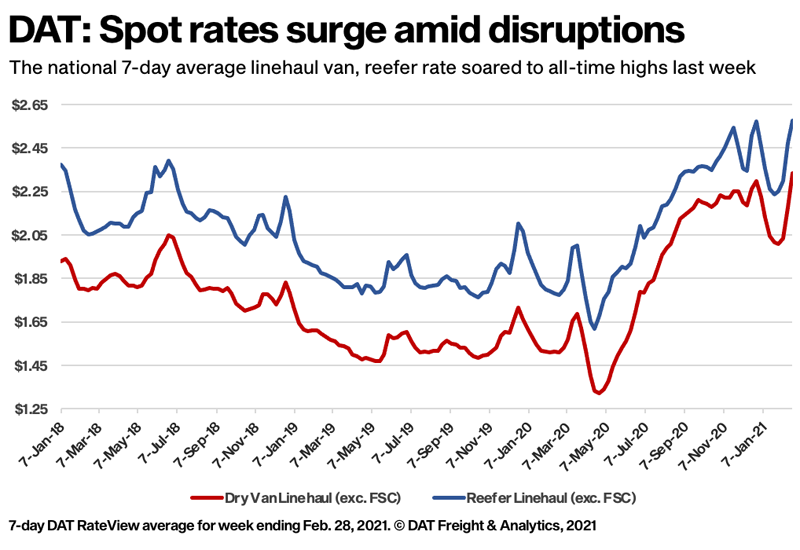

Load posts soar 24% as supply chains recover from weather disruptions

With shippers struggling with freight schedules following the recent winter storms, and intermodal network disruptions pushing more loads onto the spot market, spot truckload volumes are at record levels for this time of year.

The number of load posts on DAT MembersEdge was 24% higher while truck posts increased 11% during the week ending Feb. 28 compared to the previous week. And for the month of February, load posts were up 162% compared to February 2020, when supply chains began to experience imbalances in demand due to COVID-19.

This month, keep a look out for wild year-over-year comparisons in rates and volumes given that March 2020 was the start of shutdowns in the U.S. due to the pandemic.

National average spot rates, February

- Van: $2.40 per mile.

- Flatbed: $2.56 per mile.

- Refrigerated: $2.69 per mile.

These are national average spot market rates for the month of February. They include a calculated fuel surcharge.

Van and reefer pricing entered March well over their February averages. On March 1, the national average van rate was 18 cents higher at $2.58 per mile; the reefer rate was up 19 cents at $2.88.

Trends

Van volumes surge

Dry van load post volumes surged 28% last week as supply chains continue to recover from a month of difficult weather. Truck posts increased 22% compared to the previous week, returning to more seasonal levels. The van load-to-truck ratio averaged 10.9 last week, up from 9.6 the previous week. The average ratio in February was 7.5, up from 1.8 in February 2020.

The average spot van rate was higher on 91 of DAT’s top 100 van lanes by volume last week. Volume in those lanes increased 26.6%.

Texas-bound loads increase

Compared to the previous week, there was a 53% increase in load post volumes for flatbed freight coming into Texas markets. Reefer volumes increased 28%, and van volumes were up 25%. At $2.64 a mile, the average rate from Houston to Dallas was up 24 cents while Dallas to Houston increased 35 cents to an average of $3.26 a mile. The number of loads moved each direction increased 226% compared to the prior week, although Dallas to Houston was the far busier lane.

California keeps climbing

Outbound load volumes from Los Angeles and Ontario, Calif., last week increased 18% and 36% week over week, respectively. The average outbound rate from Los Angeles rose 23 cents to $3.07 a mile, paced by L.A. to Dallas (up 43 cents to $2.94 a mile), Stockton (up 8 cents to $3.36), Seattle (up 18 cents to $3.45), Denver (up 17 cents to $3.83), and Phoenix (up 13 cents to $3.35).

Reefer demand stays balanced

Overall spot reefer volumes were up 15% compared to the previous week, balanced by a 15% increase in truck posts. The national average reefer load-to-truck ratio was up slightly to 21.2. The number of loads moved on DAT’s top 72 reefer lanes by volume was virtually unchanged compared to the previous week. The average spot reefer rate was higher on 56 of those lanes, lower on four, and neutral on 12.

Compared to the same period in 2020, reefer load-post volume was up 306% last week. Demand for temperature-controlled equipment is exceptional for this time of year.

Midwest and West heat up

Capacity continues to tighten in Twin Falls, Idaho, after a 13% increase in volume last week. The average outbound rate increased for the third week in a row, jumping 15 cents to $2.63 a mile. Volumes in this region are up 38% compared to the previous week and almost double from two weeks ago with growers reporting a shortage of trucks to haul apples, pears, onions, and potatoes, according to the USDA. A similar shortage of trucks was reported in the Imperial and Coachella valleys of California. Week over week, the average rate from Fresno gained 21 cents to $2.76 a mile, and Ontario was up 12 cents to $3.19.

Green Bay, Wis., and Grand Rapids, Mich., both averaged more than $4 a mile last week. Green Bay increased 17 cents to $4.06, and Grand Rapids was up 19 cents at $4.07.

Flatbed load post volumes continued to rise

Flatbed volumes increased by 26% week over week and capacity continued to tighten, driving up the flatbed load-to-truck ratio to 77.4. Although 2018 was a very different economy driven by the industrial sector, the current consumer-driven economy is playing out almost identically to 2018, when capacity was regarded as being the tightest in a decade. So far, 2021 looks to be breaking all of the records set in 2018.

National average rates are derived from DAT RateView, a database of $110 billion in actual market transactions each year. Get the latest spot pricing information at DAT.com/Trendlines or take a deeper dive with Market Insights at DAT.com/blog.

Stay safe, and thank you for your hard work.