Federal agency releases analysis of VMT tax on trucks

As the Highway Trust Fund is poised to dry up by 2022, Congress is seeking a long-term solution, including a vehicle miles traveled tax. The Congressional Budget Office recently published its analysis of a VMT tax specifically on commercial trucks.

The report looks at the various scenarios that could come into play to employ a VMT tax, including benefits and consequences of doing so. It was released on Thursday, Oct. 17.

The report identified three main areas upon which lawmakers will need to decide:

- Tax base – which trucks will be taxed and on which roads the tax will apply.

- Rate structure – whether the tax will be uniformly applied to all trucks or vary by truck configuration, weight or location.

- Implementation method – assess taxes using odometer readings, radio-frequency identification readers or onboard devices such as electronic logging devices.

The Owner-Operator Independent Drivers Association, which weighed in during the data collection, is reviewing the report.

“While we’re still carefully reviewing CBO’s report, it’s no secret that Congress is looking for a long term solution to keep the highway trust fund solvent,” said Mike Matousek, OOIDA’s manager of government affairs. “A mileage tax, or VMT, is one of many options being considered. Our goal is to review the report, discuss it internally, get as much feedback as possible from our members, and make sure Congress knows where we stand on this issue.”

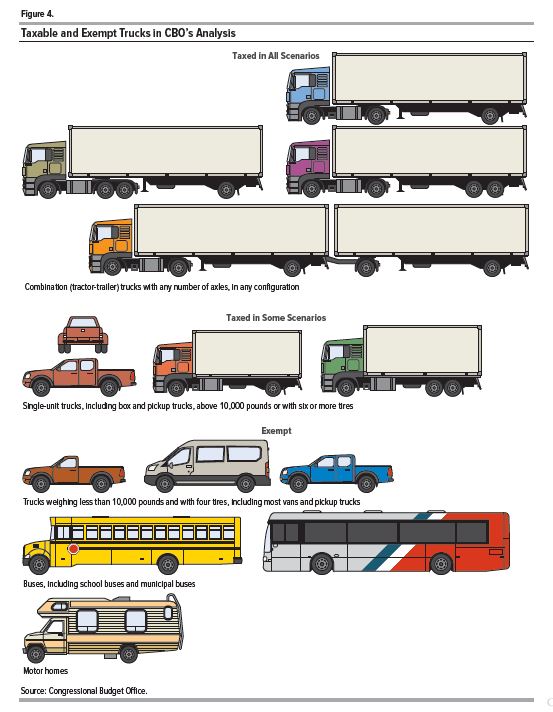

CBO’s report identified two factors to consider when deciding on the tax base: set of trucks and set of roads subject to the tax. Essentially, it is a question of whether to tax all commercial trucks or only combination trucks.

Regarding roads, will a VMT tax apply to all roads, interstates only or interstates and arterial roads?

Tax rates can also be done several ways. Much like the tax base, the tax rate can be set based on combination or single unit truck. Another tax rate could be determined by weight per axle. Location and time can also be a form of a tax rate. Certain interstates can be taxed at a variable rate at certain times.

Collection of VMT tax data can accomplished one of three ways: odometer reading, radio-frequency identification readers or through ELDs. Some tax rates would be virtually impossible with some methods. For example, location and time rates could not be applied to odometer readings.

According to CBO’s report, a tax of 1 cent per mile on all trucks on all roads would have raised about $2.6 billion for the Highway Trust Fund in 2017. Approximately $1.6 billion would have been collected if imposed only on combination trucks.

If that VMT tax rate were bumped to 7.5 cents per mile, $19.4 billion would have been collected

“That amount would be enough to replace the $14.6 billion in Highway Trust Fund taxes paid by truck owners in 2017 plus their proportional share, based on those taxes, of the $13.5 billion shortfall between the Highway Trust Fund’s tax revenues and outlays that year,” the report states.

Read the full report here.