DAT Solutions: Truckload volumes rebound, but for how long?

Van load volumes on DAT MembersEdge recovered to pre-holiday levels during the week ending Jan. 12 and grew modestly for reefers and flatbeds.

National average van and reefer rates dropped a few pennies compared to the previous week, but they’re still the highest in 13 months. Will volumes and rates stay solid or turn to slush?

National average rates, Jan. 6-12

- Van: $1.94 per mile, on par with December but trending down.

- Reefer: $2.33 per mile, 3 cents higher than December.

- Flatbed: $2.19 per mile, up 2 cents from December.

Van trends

Volumes increase, for now

Van freight volumes typically retreat in January and February, but we have yet to see it. In fact, last week’s rebound brought out more carriers to search for loads, and rates were lower on 73 of DAT’s top 100 van lanes.

Denver and Buffalo, New York, bucked the trend. Several lanes stood out, although the return rates make them prime candidates for a DAT tri-haul.

- Buffalo to Chicago gained 12 cents to an average of $1.77 per loaded mile, although the return trip fell 26 cents to $2.78.

- Buffalo to Charlotte rose 16 cents to $2.43 a mile while Charlotte to Buffalo lost 38 cents to $2.24.

- Denver to Albuquerque rose 9 cents to $2.17 per mile. The return lost 17 cents to $2.30, though, and it’s hard to find a load on that route.

- Denver to Houston gained 4 cents to $1.31 per mile. Houston to Denver went for $2.06, up 5 cents.

On the downside, van rates out of Los Angeles and Stockton, Calif., declined.

L.A. to Chicago fell in both directions; the eastbound leg lost 15 cents to average $1.39 a mile, and westbound fell 5 cents to $1.50. Stockton to Los Angeles averaged $1.68 per mile, down 17 cents, and L.A. to Stockton—the more popular direction—was 12 cents lower at $2.88.

Reefer trends

Neutral volumes

Volumes were virtually unchanged from the previous week and you shouldn’t have trouble finding a spot reefer load in most of the usual places. But rates were up on only 15 of the top 72 high-volume lanes last week.

Most of those improvements were out West. On the downside, rates on lanes heading north from Miami and Lakeland, Florida, were lower after big increases in the previous week. Miami to Baltimore plummeted 21 cents to $1.70 per mile.

Reefer rates do tend to rise when the weather is bad because there’s less competition and shippers and brokers could be looking for reefer trailers to keep temperature-sensitive cargo from freezing. It’s a way to keep the trailer full if you can’t find better-paying freight.

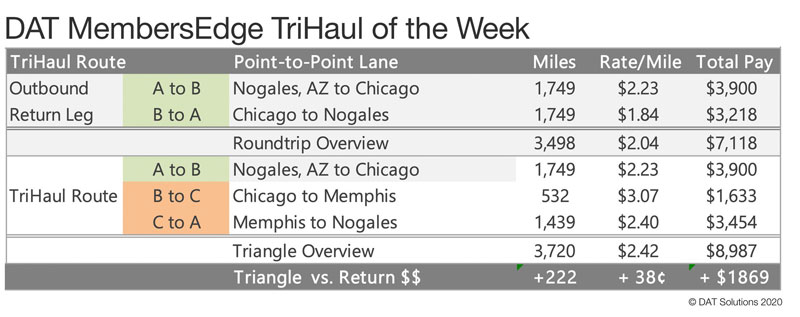

Tri-haul of the week

Nogales-Chicago-Memphis-Nogales

There’s plenty of reefer freight crossing into the U.S. at Nogales, Ariz. One of the main destinations is Chicago.

Last week, Nogales to Chicago averaged $2.23 a mile but the return paid only $1.84. You can do better with a tri-haul—that’s DAT’s name for a triangular route. The professional version of DAT MembersEdge will give you suggestions for a better-paying route to Nogales.

One suggestion: head back through Memphis, Tenn. Chicago to Memphis averages $3.07 per mile right now while Memphis to Nogales pays $2.40. The three-legged route averages $2.42 per mile and would produce $8,987 in revenue, or 38 cents a mile better than the round trip.

Remember, these rates represent averages from last week and this week could be different. Negotiate the best deal you can get on every haul, and look at the rates and load-to-truck ratios in MembersEdge to understand which way the rates are trending.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.

For the latest spot market load availability and rate information, visit the load board or tune in to Land Line Now. You can get all of the latest rate information at DAT.com per industry-trends per Trendlines, comment on the DAT Freight Talk blog, or join us on Facebook. On Twitter you can tweet your questions to us @LoadBoards and have your questions answered by DAT industry analyst Mark Montague.

Check out last week’s report from DAT Solutions.