DAT Solutions: Truckers face softer spot freight market, fewer load posts

The number of available load posts on DAT MembersEdge fell 5 percent last week, running counter to the typical seasonal bump in demand for trucks.

Truck posts were down less than 1 percent as national average spot rates declined for all three equipment types.

- Van: $2.08 per mile, erasing a 6-cent gain from the previous week.

- Flatbed: $2.42 per mile, down 1 cent.

- Reefer: $2.42 per mile, down 4 cents.

Van trends

Spot van activity continues to slow, sending rates lower. Average rates fell on 62 of the top 100 van lanes.

Surcharge slips

The linehaul or “demand” component of the spot van rate has gained strength in recent weeks, but the falling fuel prices have held rates down. The average price of on-highway diesel was $3.12 per gallon on Dec. 17, a 4-cent decline compared to the previous week.

Rates soften

Outbound spot van rates were softer in major markets, and a general lack of demand in the Northeast indicates that shippers have increased their use of intermodal and contract carriers.

- Buffalo, $2.56 per mile, down 10 cents.

- Columbus, Ohio, $2.50 per mile, down 3 cents.

- Memphis, $2.29 per mile, down 7 cents.

- Chicago, $2.51 per mile, down 5 cents.

- Los Angeles, $2.55 per mile, down 13 cents.

Flatbed trends

After a 103 percent increase the previous week, the number of flatbed load posts were down 4 percent while truck posts slipped 3 percent. As a result, the national flatbed load-to-truck ratio dipped from 19.8 to 19.6 loads per truck.

Reefer trends

Reefer load posts were virtually unchanged following a 46 percent increase in load posts the previous week. The number of truck posts also remained the same, as did the national load-to-truck ratio at 6.3 reefer loads per truck.

Ups and downs

On the top 72 reefer lanes, 30 were up and 39 were down. Three were neutral.

Big McAllen

While volumes were generally down across most of the country, load counts out of Texas were up 11 percent compared to the previous week. Those Texas numbers are largely thanks to the McAllen market in the Rio Grande Valley. Crops are harvested on both sides of the border during the winter months, and the reefer ratio shot up to 13.2 loads per truck last Friday.

- McAllen to Dallas was up 7 cents to $2.84 per mile.

- McAllen to Chicago averaged $2.03 per mile.

- McAllen to Elizabeth, NJ was up to $2.25 per mile.

Get Your Phil

The biggest reefer-rate increase was Atlanta to Philadelphia, which jumped 31 cents to $3.06 per mile.

Regional roundup

- Reefer rates on regional lanes were unspectacular but solid.

- Green Bay to Wilmington, Ill.: $3.67 per mile, up 12 cents.

- Atlanta to Lakeland, Fla.: $3.34 per mile, down 1 cent.

- Ontario, Calif. to Phoenix: $3.68 per mile, down 5 cents.

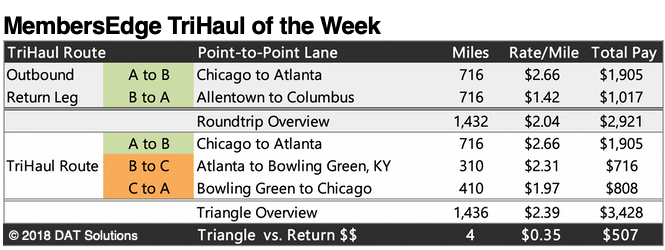

Tri-haul of the week

Chicago- Atlanta-Bowling Green-Chicago

Spot van prices from Chicago have held up better than in most markets, and the average rate to Atlanta was $2.66 per mile last week. The return trip was just $1.42.mile, however.

There is a better-paying route. For example, Atlanta to Bowling Green, Ky., averaged $2.31 per mile last week, and Bowling Green to Chicago was $1.97 per mile. Since Bowling Green is en route to Chicago, the added mileage would be however far off I-65 you have to go for the extra drop and pickup. Last week this tri-haul would have added 35 cents to your average rate per loaded mile, which works out to an extra $507 in revenue.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.

For the latest spot market load availability and rate information, visit the MyMembersEdge.com load board or tune in to Land Line Now. You can get all of the latest rate information at dat.com per industry-trends per trendlines, comment on the DAT Freight Talk blog, or join us on Facebook. On Twitter you can tweet your questions to us @LoadBoards and have your questions answered by DAT industry analyst Mark Montague.