DAT Solutions: Spot van rates (finally) pick up as holiday freight gets moving

The number of load posts on DAT MembersEdge closed the month of October on a high note, increasing 16% during the week ending Nov. 3. That’s a sign that holiday freight is moving, at least in the spot van and reefer segments.

The number of truck posts fell 8%, which helped lift load-to-truck ratios and give van lane rates a boost after several weeks of declines.

National average spot rates for October

- Van: $1.80 per mile, 4 cents lower than the September average.

- Flatbed: $2.17 per mile, 3 cents lower compared to September.

- Reefer: $2.11 per mile, 5 cents lower than September.

National average rates during the first three days of November were lower than October but were unchanged compared to the previous week: van, $1.79 per mile; flatbed, $2.12; and reefer, $2.09.

Van trends

As holiday freight picks up, spot van rates were higher on 59 of DAT’s top 100 largest van lanes by volume. Two big retail freight hubs – Los Angeles ($2.23 per mile, up 6 cents) and Columbus, Ohio ($2.14 per mile, up 7 cents) – set the pace for other rising markets.

Where van rates were up

Rates increased on van lanes into the Northeast, including:

- Chicago to Buffalo, $2.59 per mile, up 14 cents.

- Charlotte to Buffalo, $2.06 per mile, up 10 cents.

Where lane-rates declined, most drop-offs were mild. Some of the areas where rates fell the most involved shorter, regional lanes.

Flatbed trends

Spot flatbed rates dipped as volumes declined for the fifth consecutive week. The flatbed load-to-truck ratio averaged 10.8 in October, down from 14.7 in October 2018 and 37.5 in October 2017.

Speaking of holiday freight, Christmas tree growers in North Carolina and Oregon, where six counties in the two states account for more than half of the 16 million trees harvested nationwide, are a huge source of spot flatbed loads in November. Other major markets: Spokane, Wash.; Missoula, Mont.; and Rapid City, S.D.

But weakness from traditional freight sources – construction, oil and gas, machinery, agriculture – has caused the number of available loads to tumble.

Where flatbed rates were up

Spot rates increased in many of the port markets on the Atlantic coast, including Baltimore; Savannah, Ga.; and Jacksonville, Fla.

Houston averaged $2.30 per mile, down 7 cents due in part to the slowdown in oil and gas production and development. Key outbound lanes were lower.

- Houston to Wichita, Kan. – $2.03 per mile, down 48 cents after a 38-cent gain the previous week.

- Houston to New Orleans – $2.37 per mile, down 28 cents.

Tri-haul of the week

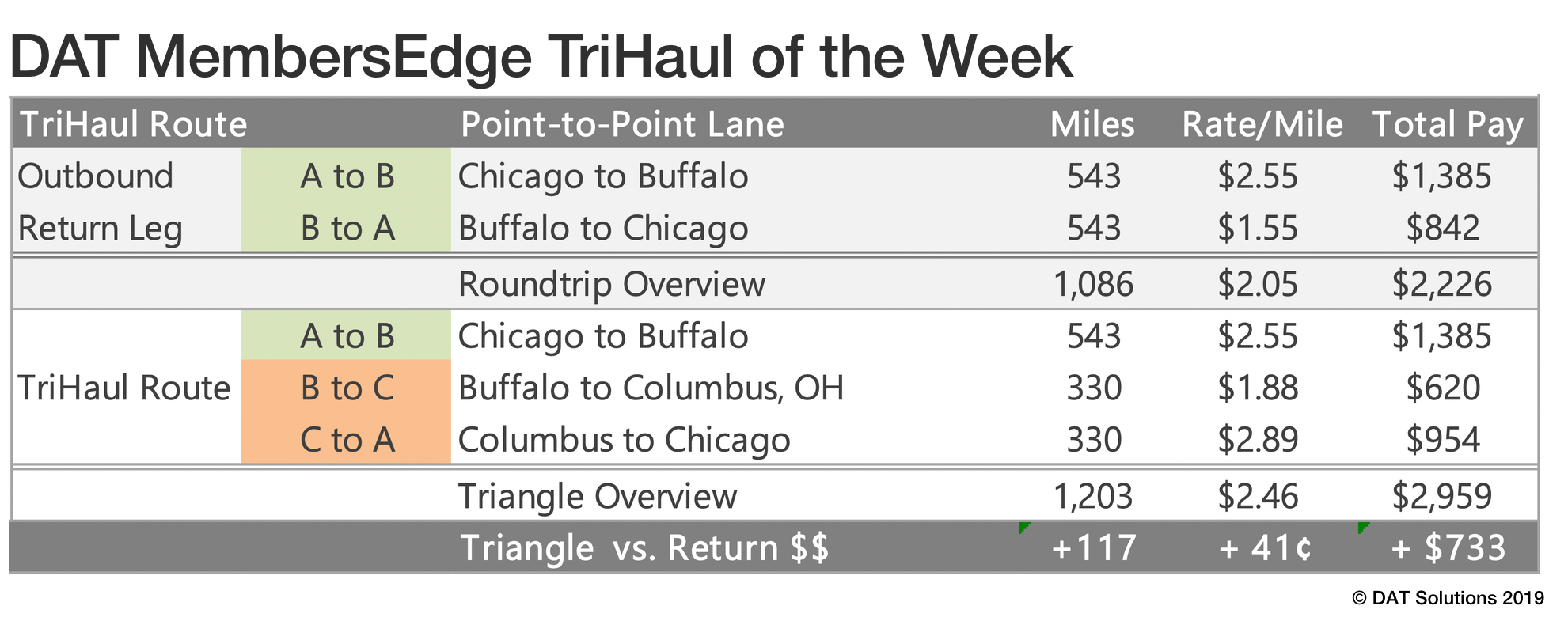

Chicago-Buffalo-Columbus-Chicago

A tri-haul is where we take a roundtrip between major markets and add a third market to make it more profitable if it works with your schedule.

The average spot van rate from Chicago to Buffalo was $2.55 per mile last week while the return trip paid a paltry $1.55 a mile. The Pro version of MembersEdge can give you suggestions for a better-paying third leg. For example, instead of going from Buffalo straight back to Chicago, the average from Buffalo to Columbus paid $1.88 per mile last week. Columbus to Chicago paid $2.89 per mile.

So the straight round trip averaged $2.05 per loaded mile but the tri-haul works out to $2.46, an increase of 41 cents per mile. It adds 117 loaded miles to the trip and increases revenue by $733 for a total of $2,959.

These rates are averages from last week, and this week will be different. Talk to the load providers and negotiate the best deal you can get on every haul, and look at the rates and load-to-truck ratios in MembersEdge to understand which way the rates are trending.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.

For the latest spot market load availability and rate information, visit the load board or tune in to Land Line Now. You can get all of the latest rate information at dat.com per industry-trends per Trendlines, comment on the DAT Freight Talk blog, or join us on Facebook. On Twitter you can tweet your questions to us @LoadBoards and have your questions answered by DAT industry analyst Mark Montague.