DAT Solutions: More freight is moving, but rates lag

Last week we saw a nice bump in the number of actual loads moved for vans and reefers, and load counts shot up in three of the country’s busiest van markets. Reefer volumes are unusually high for this late in the fall. Still, national average spot van, reefer, and flatbed rates on DAT MembersEdge were flat compared to the previous week. Load postings fell 5% nationwide, and truck posts dipped 1%.

National average spot rates for October (through Oct. 22)

- Van: $1.81 per mile, 3 cents lower than the September average.

- Flatbed: $2.20 per mile, unchanged compared to September.

- Reefer: $2.12 per mile, 4 cents lower than September.

Van trends

Spot van rates were higher on 33 of the top 100 van lanes by volume. Chicago, Dallas and Los Angeles all had more loads last week, although average outbound rates declined in each market. In Los Angeles, the load-to-truck ratio hit 4.1 last Friday after starting the week at 2.5 (neutral) and dipping as low as 1.8 on Tuesday. It’s a sign that West Coast import traffic is moving, which is good news for truckers looking for loads.

Where rates were up

Volume from Seattle increased and the average outbound rate there gained 5 cents to $1.58 per mile compared to the previous week. Key lanes:

- Seattle to Salt Lake City, up 7 cents to $1.94 per mile.

- Seattle to Los Angeles, up 6 cents to $1.36 per mile.

Seattle is the only major van market where rates are higher over the past four weeks.

Reefer trends

A combination of produce from Mexico and strong ag shipments from California, Florida, Texas, and the Upper Midwest pushed spot reefer volumes up 9% over the past four weeks yet the national average spot reefer rate has declined 3% at the same time.

Where rates were up

Reefer volumes from Nogales, Ariz., increased 68% week over week and the average outbound rate rose 7 cents to $1.75 per mile. The lane from Nogales to Los Angeles jumped 15 cents to $1.73 a mile.

Other high-volume markets last week also had plenty of trucks, which helped keep rates in check.

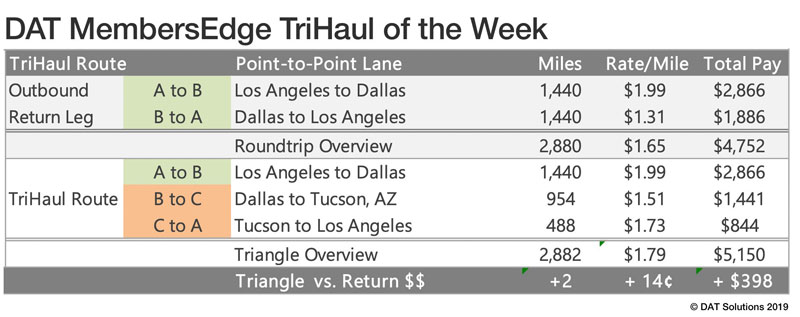

Tri-haul of the week

Los Angeles-Dallas-Tucson-Los Angeles

Higher reefer load counts coming out of Los Angeles means there are plenty of opportunities to find freight. A tri-haul can help you get back there again at a decent rate.

For instance, Los Angeles to Dallas averaged $1.99 per mile last week – not bad, but the return paid just $1.31. So consider a third leg to Tucson, Ariz.:Dallas to Tucson paid $1.51 a mile and Tucson to L.A. paid $1.73. (If you have trouble finding freight in Tucson, you can search the border-crossing area at Nogales, which is 65 miles south.)

The straight L.A.-Dallas round trip averaged $1.65 per mile but the tri-haul would work out to $1.79. All told, that third leg would produce $398 more in revenue without really adding miles to your trip.

Remember, these rates are averages from last week, and this week will be different. Talk to the load providers and negotiate the best deal you can get on every haul, and look at the rates and load-to-truck ratios in MembersEdge to understand which way the rates are trending.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.

For the latest spot market load availability and rate information, visit the MyMembersEdge.com load board or tune in to Land Line Now. You can get all of the latest rate information at dat.com per industry-trends per Trendlines, comment on the DAT Freight Talk blog, or join us on Facebook. On Twitter you can tweet your questions to us @LoadBoards and have your questions answered by DAT industry analyst Mark Montague.