DAT Solutions: After a strong start, spot rates slip

National average spot truckload van and refrigerated rates on DAT MembersEdge slipped below December averages last week after a strong start to the month. There was better news for flatbed haulers as the national average spot rate crept higher on the strength of new oil and gas projects.

National average spot rates, January (through Jan. 19)

- Van: $1.92 per mile, 2 cents below the December average.

- Reefer: $2.29 per mile, down 1 cent from December.

- Flatbed: $2.18 per mile, up 2 cents from December.

Van trends

The van load-to-truck ratio was 2.1 last week, meaning there were 2.1 loads for every truck posted on the DAT network. That’s down from 3.2 in the previous two weeks, and van rates generally shifted lower as a result.

Most of the lanes with better rates last week don’t pay well to begin with, and those increases were offset by poor rates for the return trip. Still, there were lanes where the round trip average was priced well for carriers:

- Seattle to Spokane was up 12 cents to $3.29 per mile. Spokane to Seattle lost 4 cents to $2.84, although load availability was low. The roundtrip averaged $3.06.

- Denver to Phoenix was up 4 cents to $1.34 per mile. Phoenix to Denver paid $2.27, down 10 cents, for a roundtrip average of $1.81. Running between

- Denver and Albuquerque paid better at an average of $2.06 per loaded mile.

- Dallas to Memphis was up 5 cents to $1.33 per mile. Memphis to Dallas dropped 4 cents to $2.38 for a roundtrip average of $1.86.

- Chicago to Los Angeles rose 5 cents to $1.55 per mile. L.A. to Chicago fell 2 cents to $1.37 for a roundtrip average of $1.46. At least there were lots of loads to choose from.

Flatbed trends

We expect low flatbed rates in January, when volumes are down. What’s different this year is that after reducing the number of active wells in 2019, U.S. oil and gas producers are adding wells this month, and spot pricing reflects higher demand:

- Houston to Fort Worth: $2.51 per mile, up 8 cents. Ft. Worth to Houston averaged $2.13 per loaded mile, up 3 cents.

- Houston to Laredo: $2.45 per mile, up 12 cents. Laredo to Houston increased 2 cents to $2.19.

- Houston to Lubbock: $2.48, up 13 cents. The return trip averaged just $1.28, however.

Expect more flatbed activity in the Upper Mountain and Plains states come spring. This week the Trump administration approved a right-of-way grant allowing the Keystone XL pipeline to be built across 44 miles of federally managed land in Montana. While the project still faces court challenges, flatbeds are being used to stage building materials and supplies at future construction sites.

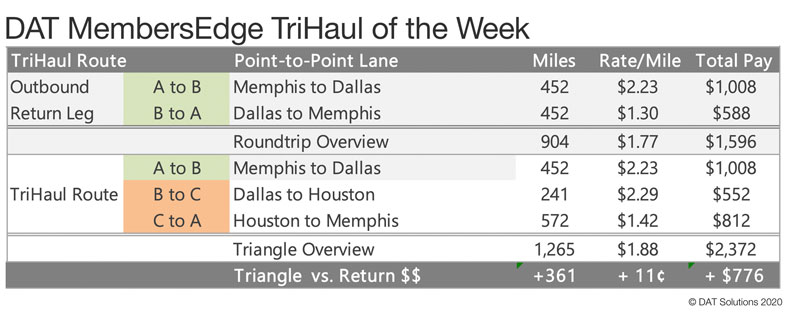

Tri-haul of the week

Vans, Memphis-Dallas-Houston-Memphis

Bad weather across the northern U.S. has caused van rates and schedules to fluctuate, so let’s look south for something more reliable.

Last week Memphis to Dallas averaged $2.23 per mile, well above the national average. But the return trip paid just $1.30. That’s an average of $1.77 per loaded mile, and the round trip means driving more than 450 miles each way. If it looks like you’ll be on the road for three days instead of two, the Professional version of DAT MembersEdge can automatically suggest two higher-paying triangulating lanes instead of one return trip. We call that a tri-haul.

For instance, instead of booking a load directly back to Memphis, Dallas to Houston currently averages $2.29 per mile – not bad. Houston to Memphis pays $1.42, which is better than the $1.30 rate from Dallas to Memphis. All told, the tri-haul through Houston averages $1.88 per mile and adds 361 paid miles to the trip. Total revenue is $2,400, an $800 difference. If it works with your schedule and hours of service, this could be a good choice for you.

These rates represent averages from last week, and this week will be different. Negotiate the best deal you can on every haul, and look at the rates and load-to-truck ratios in MembersEdge to understand which way the rates are trending.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.

For the latest spot market load availability and rate information, visit the load board or tune in to Land Line Now. You can get all of the latest rate information at DAT.com per industry-trends per Trendlines, comment on the DAT Freight Talk blog, or join us on Facebook. On Twitter you can tweet your questions to us @LoadBoards and have your questions answered by DAT industry analyst Mark Montague.